Published on March 14, 2020

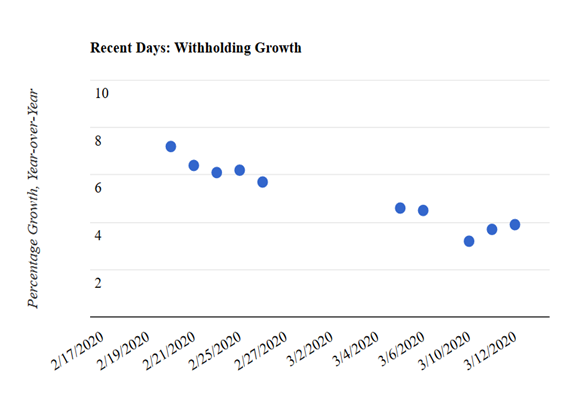

First, stay safe and healthy. Second, we are probably already seeing the effects on federal withholding tax collections from the sweeping economic disruptions caused by the efforts to contain the spread of the coronavirus. In the first half of March, growth in those daily amounts withheld from paychecks averaged about 4 percent (comparing the withholding amounts this year to the amounts from a year ago; see chart above). That is a significant drop from the 6.3 percent growth estimated for February. Over a long period of time, the withholding tax measure (which is adjusted to remove the estimated effects of law changes) has correlated well with overall wages in the economy (see the chart below). And the withholding data don’t measure the big financial hit underway on business earnings, including the earnings of self-employed workers. It’s hard to see how we avoid a recession while dealing with this public health crisis. For many that means severe economic hardship along with other types of stress, not to mention the potential for illness.

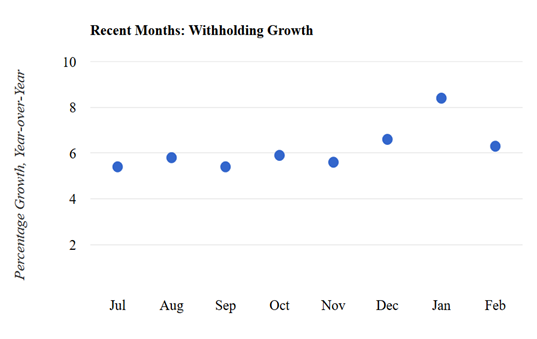

We haven’t seen tax withholding growth rates as low as 4 percent in a while: growth moved in a narrow band of 5.5 percent to 6 percent from July through November of last year, before moving up temporarily in December and January (see third chart below). Year-end bonuses and other irregular income can often cause withholding to move off trend in December and January, and then revert after that. Withholding growth in February did revert most of the way back, but now we are seeing the lowest growth in more than a year, and it’s been about four years since growth has fallen much below 4 percent. Unfortunately, this could well be just the beginning of the decline.

The tax withholding measure is very current but also often quite volatile. It is very current because the largest employers, representing much of the employment base, remit withholding taxes to the Treasury Department one day after paying their workers, and then Treasury releases the data on the total amount remitted the day after that. The withholding measure can also be volatile because withholding is subject to many calendar effects that do not reflect underlying movements in the economy. Although my filtering of the withholding data is intended to remove those calendar effects (see methodology), the period around February of a leap year would be a prime candidate for an unanticipated effect. But I don’t see any such measurement issues with February and March from leap years in the past. And, as I wrote earlier, withholding growth had been very stable for a number of months, except for those most affected by year-end bonuses. The weak withholding data in recent days seem to point to the economic disruptions.

We will need to see the data for the rest of March to be sure that the withholding slowdown we are seeing is not a data anomaly. We are about to enter the mid-month period of several days in which we cannot get reliable estimates of withholding growth, but by Friday of next week we start to get measurements again. Stay tuned and stay safe.