Posted on February 2, 2025

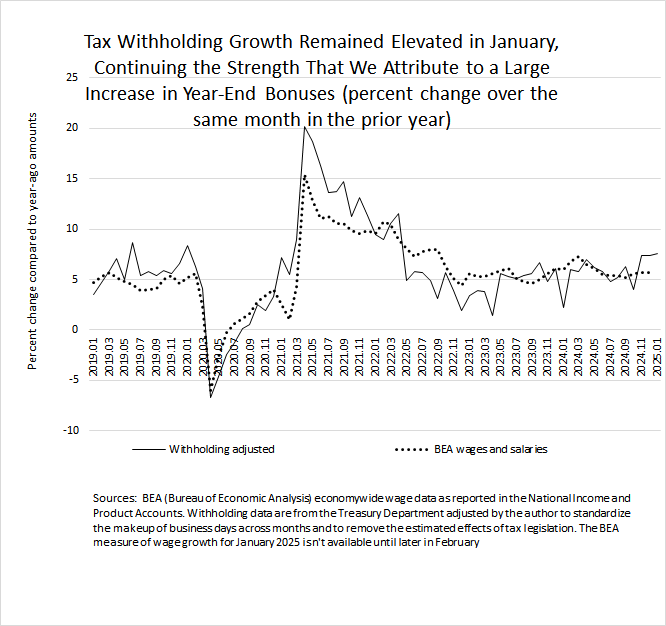

Federal tax withholding in the months of December and January are often volatile because of the effects of year-end bonuses, and we believe that high growth in year-end bonuses on Wall Street and elsewhere in the past two months have boosted tax withholding. We estimate that federal tax withholding–the combined amount of income and payroll taxes withheld from employees’ paychecks and remitted by firms as soon as the next day to the U.S. Treasury Department–grew in January by 7.6 percent above the amount from January 2024. That marks the third consecutive month in which withholding growth has been around 7.5 percent, which is above the range of 5 percent to 7 percent recorded in most months from May 2023 until late last year (see chart below). The overall amount of withholding is directly related to the economywide amount of firms’ payrolls, including bonuses. While we attribute the relatively high growth in December and January to bonuses, the high growth in November we attribute to a catch-up primarily related to hurricanes that lowered withholding in October. The effects of year-end bonuses tend to ebb in February, so we will soon find out if the relatively high withholding growth in recent months is indeed temporary.