Posted on October 23, 2023

When I worked in the federal government tracking and forecasting federal tax collections, we would keep track of the IRS-granted tax-filing and payment delays allowed for taxpayers in areas of the country affected by natural disasters. Those payment delays never moved the overall revenue needle much, but that appears to be quite different this year. Payments of nonwithheld individual income taxes and payments of corporate income taxes have surged this October compared with Octobers in recent months, and delays resulting from natural disasters in California are the likely source.

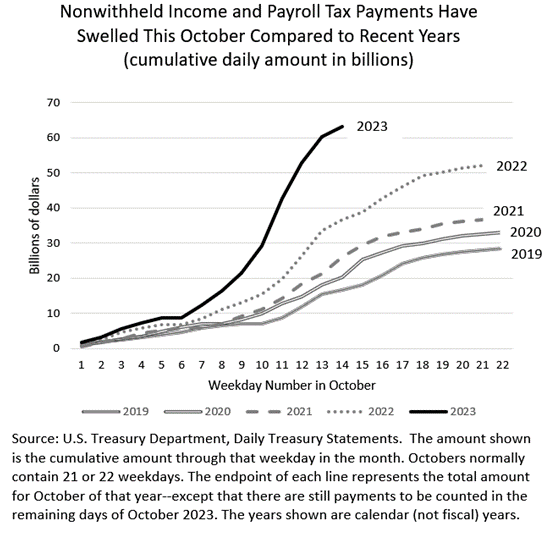

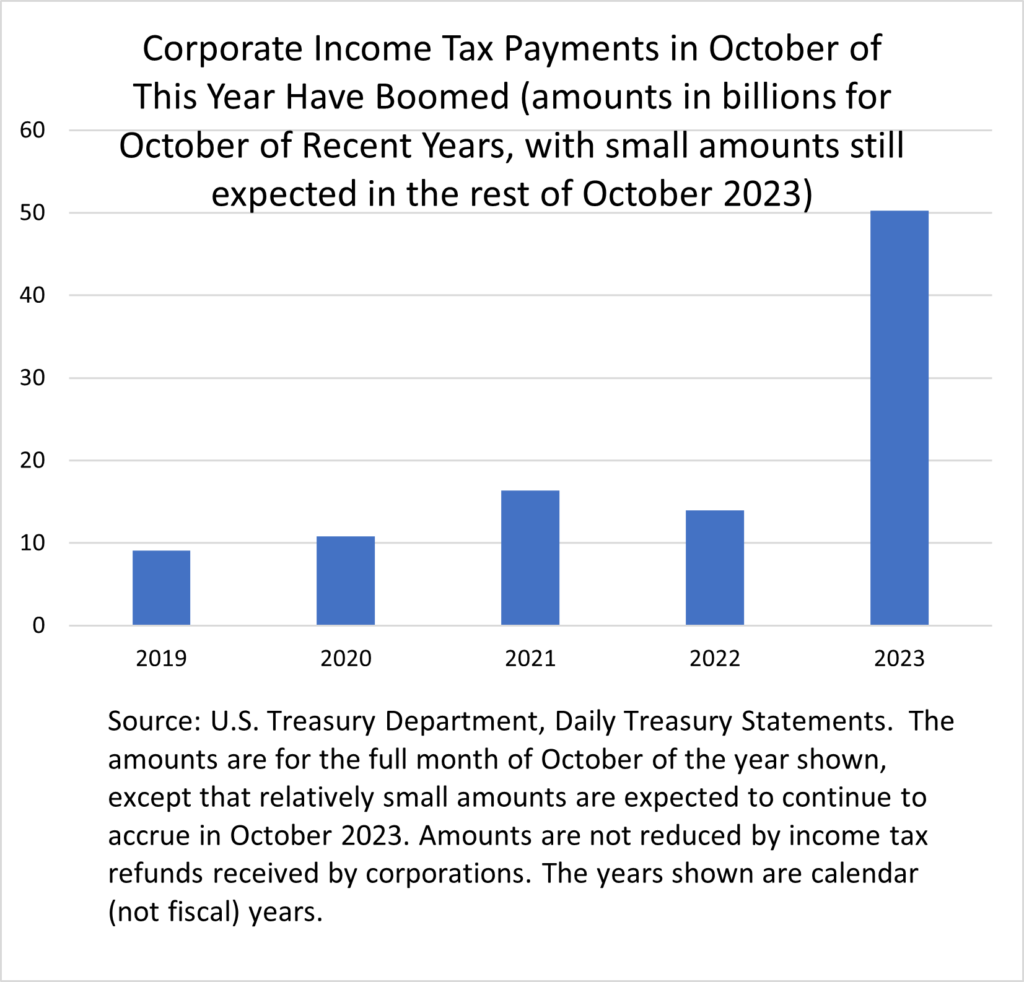

Specifically, nonwithheld individual income tax payments (and which include payroll taxes) so far this month are running about 73 percent above the amounts at the same point in October of a year ago (see first chart below). (Nonwithheld receipts consist mainly of payments due with tax returns for the prior year and quarterly estimated payments due in mid-April, June, September, and December.) In addition, corporate income tax payments are running about 3-1/2 times above last October’s total, with some additional small amounts of corporate receipts still expected to come in by the end of the month (see second chart below).

The main payment relief that delayed revenue from earlier in 2023 to this month stems from California. Three storms last winter–which included flooding, mudslides, and landslides–prompted disaster declarations and the IRS to grant tax filing and payment relief to taxpayers in most all of California. Most significantly, those taxpayers–both individual and corporate–could delay making their first three quarterly estimated payments for the year (normally due in the middle of April, June, and September) until mid-October, and they were allowed to not only delay filing their tax returns for 2022 until October (which all taxpayers can do every year), but to also delay paying the taxes due with the return (which taxpayers normally cannot do–they must pay amounts due by mid-April even if they file for an extension or likely be subject to interest and penalties).

Interestingly, the IRS on October 16, which was the extended due date for the payments for affected California taxpayers, extended the relief further to November 16. Given that corporations generally set up their payments in advance of the due date, and individuals don’t wait around on the due date to see if there will be another extension, it doesn’t seem likely that the extended relief will have a big effect. It will presumably affect taxpayers who weren’t going to be able to meet the October 16 deadline in any event.

It is difficult to go back and recalculate how the different categories of tax receipts would have been different without the delays. It seems pretty clear that we would have seen a smaller decline in tax receipts with individual income tax returns in April if the natural disasters and filing delays had not occurred. For nonwithheld receipts, in the tax filing season from February to April (and the counting continued into May) they fell by about 38 percent, or about $260 billion, compared to the amount in the prior year. That surprising weakness was a major cause of the over $300 billion increase in the federal budget deficit for the year (which concluded in September), from $1.4 trillion in fiscal year 2022 to $1.7 trillion in fiscal year 2023. It looks like those nonwithheld receipts in October could be up by perhaps $40 billion when the month is complete, if they continue at the same higher pace for the remaining days this month. If half of that $40 billion is from final payments with tax returns and the other half is from three quarterly estimated payments, then nonwithheld receipts might have been higher in the February-April period (without the natural disaster and payment delays) by around $25 billion, and the overall decline in nonwithheld receipts would have been about 34 percent instead of 38 percent; the needle moves, but not dramatically. Even if all $40 billion is attributed to April receipts, the decline would have been 32 percent–still very significant.

The corporate income tax story is a bit harder to disentangle with only payment totals being available. I don’t know how much of total corporate tax receipts comes from corporations based in California. Technically, even a firm based outside the disaster-affected area can get the tax payment relief if it has records necessary for tax filing located there. There is the possibility that factors other than the disaster-related payment delays could be contributing to the October payment surge in corporate income taxes.

The jump in corporate income tax receipts in October is relatively much larger than that for individual nonwithheld tax receipts, and here the needle does move significantly. Gross federal corporate tax receipts (that is, payments not reduced by refunds received) fell by about $27 billion (or 8 percent) for the period from April through September 2023 compared to the same period in 2022. If the roughly $40 billion jump in payments in October–which would be in line with the dollar increase in nonwithheld receipts but on a much smaller base–had instead been paid in that April-September 2023 period, corporate payments would have increased instead of fallen.

It is also possible that withholding tax receipts have been affected by the payment delays, although that should be a much more muted effect. Business taxpayers in affected disaster areas have been allowed to delay filing their quarterly withholding forms, and the associated extensions for California firms mirrored the other extensions. Some, mainly very small firms are always allowed to remit their withholding taxes when they submit those forms (rather than remit the amounts close to when they pay their workers like larger firms, which remit the overwhelming share of withholding taxes, are required to). We have observed withholding tax receipts taking a bit of a step up so far in October, and payment delays for smaller firms may be contributing to that.

And it isn’t only California. In recent months there have been a significant number of natural disasters leading to IRS-granted payment and filing delays. By my count areas of Georgia, Louisiana, Maine, Hawaii, South Carolina, and Massachusetts have been so affected. Some of those have tax deadlines that have been postponed until February 2024. Those extensions should not have anywhere near the magnitude of the effect on tax receipts as do the ones for California residents.