Posted on May 4, 2022

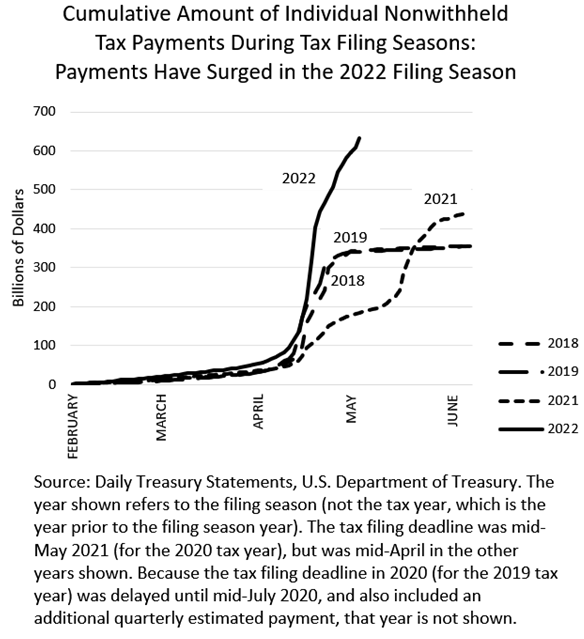

The counting by the Internal Revenue Service isn’t finished, but it is crystal clear that individuals’ income tax payments with 2021 tax returns filed by mid-April have surged this year. Tax payments from the beginning of February (when the filing season roughly began) through May 3 this year have totaled $634 billion, about 45 percent higher than amounts paid through early June last year, when the delayed filing date caused receipts to be counted later than usual (see chart below). In pre-pandemic years with the normal filing deadlines (like this year), the IRS was just about finished at this point in early May with the depositing of payments with timely-filed tax returns; so we expect the daily amounts to start tailing off very soon, but that 45 percent increase this year can only get larger. And this year’s big increase is on top of last year’s big payment season, when payments with tax returns were up by about 23 percent compared to amounts paid two years prior in 2019, before the pandemic–an unusual increase given the recession that normally causes payments with tax returns to drop significantly (see post from last year). We expect that the revenue haul is large enough to cause significant downward adjustments to most analysts’ estimates of the federal deficit for the 2022 federal fiscal year that ends on September 30.

We infer from the revenue surge that taxable incomes of higher-income taxpayers have increased substantially in the past two years, especially in 2021. Taxpayers with more than $100,000 in income, representing about 20 percent of taxpayers, accounted for almost 90 percent of payments with tax return filings in recent years, and those with more than $200,000 (about 6 percent of taxpayers) have paid more than three-quarters of the total amounts. We expect that there was rapid growth in 2021 in capital gains realizations and other business-related income, such as income from partnerships and sole proprietors. Those incomes are highly concentrated in higher-income individuals. The last year for which we have tax return tabulations from the IRS is 2019, so we don’t yet know the amount of capital gains or other incomes from tax returns for 2020 or 2021.

The amounts paid since February include not just final payments of 2021 taxes but also the first quarterly estimated payment for the 2022 tax year. The estimated payment component is generally relatively small, but is presumably rising sharply as well. When taxpayers have big tax bills in April, that often causes them to raise their estimated payments for the new tax year in order to avoid having a tax penalty when filing the next year’s taxes. However, based on information from previous years, the surge this year can be largely traced to final payments with 2021 tax return filings rather than from the first quarterly payment for 2022.