Posted on February 12, 2025

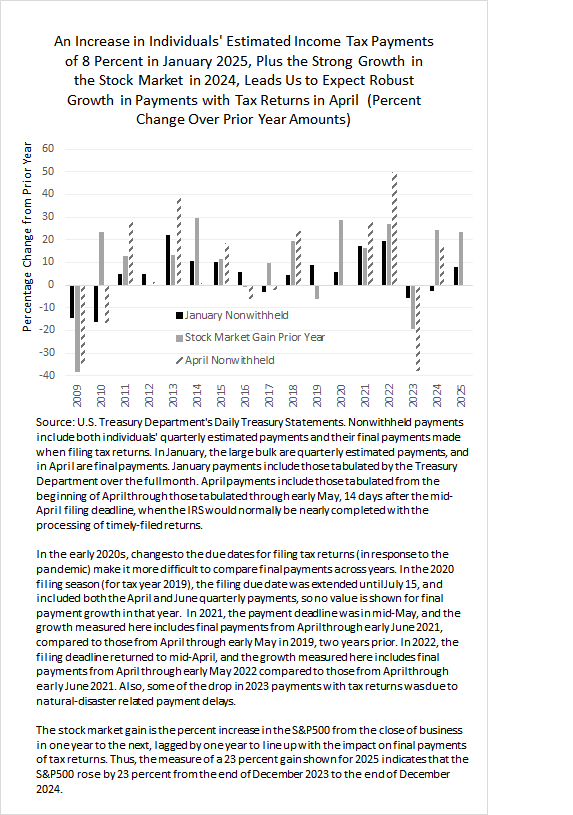

The IRS has completed tabulating the amounts of individuals’ January quarterly payments of estimated federal income taxes, the last quarterly payment for the 2024 tax year. Based on information from the U.S. Treasury’s Daily Treasury Statement, we estimate that those payments rose by about 8 percent above the amounts from January 2024, a healthy increase. An 8 percent increase in the January estimated payment is in that intermediate range where historically we have generally seen either very significant increases in final payments with tax returns in April or something much less substantial (see chart below). However, combining that information about the estimated payments with the very significant stock market increase of over 20 percent in 2024, we expect a robust increase in final payments in April.

Quarterly estimated payments and final income tax payments with tax return filings are overwhelmingly made by high-income households, with their income often including significant amounts of capital gains realizations and business income, both of which can fluctuate significantly. Given the big increase in the stock market in 2024 and the healthy increase of 8 percent in the January quarterly estimated payment, it is very unlikely that we will see a sharp drop-off in final payments; the big drop-offs in final payments in the past have typically followed declines in capital gains realizations and the January quarterly payment. The reverse often happens following boom stock market years. High-income taxpayers often utilize one of the “safe harbor rules” for paying estimated payments through the tax year, setting in advance their quarterly payments so that, when combined with any income tax withholding amounts, they total 110 percent of the previous years’ total income tax amount. (The safe harbor is 100 percent for taxpayers with adjusted gross income below $150,000.) That safe harbor insulates individuals from any IRS penalty for paying an insufficient amount of their total tax liability throughout the year. That safe harbor does, however, make final payments with tax returns very volatile, because taxpayers utilizing that safe harbor were not adjusting their estimated payments throughout the year to reflect their actual income.