Posted on July 5, 2022

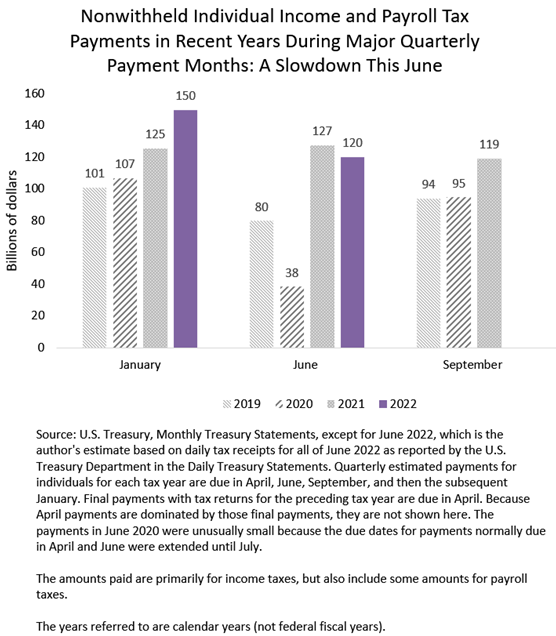

Well, we’ve previously observed a slowdown over the past two months in income and payroll taxes withheld from workers’ paychecks and remitted to the U.S. Treasury, and then quarterly estimated income tax payments by corporations in June, and now we can add to the list quarterly estimated payments of individuals in June. Those individual quarterly payments in June were about 9 percent lower than the amount from June of a year ago, and a substantial 20 percent lower than those in January 2022, based on our estimates of quarterly payments in June from the Daily Treasury Statements for the month (see chart below). The official estimates for June will be released next week by the Treasury Department in the Monthly Treasury Statement.

Although individuals’ estimated payments in June 2022 were lower than in June 2021, they remain well above those from June 2019, before the pandemic. (The amounts from June 2020 are not comparable because of payment due date delays at the beginning of the pandemic.) And the 20 percent drop-off compared to the January estimated payment probably overstates the size of the June decline, because January’s estimated payment, the last one for the 2021 tax year, probably reflected some catch-up for the strong stock market in 2021; indeed, final payments with tax return filings in this past April were very large.

So what do weak quarterly payments of individuals tell us? Quarterly estimated payments largely reflect nonwage income such as capital gains and other business-related income. It would not be a surprise that after the very poor first half of the year for the stock market, and with a general slowing in economic growth and business activity, that those quarterly payments would decline some. In any event, the decline is just another indicator of a slowing economy.

Note, however, that quarterly estimated payments mainly provide information about how higher-income taxpayers are faring. In 2019, the last year for which we have detailed data from the IRS, about 94 percent of quarterly estimated payments of individuals were made by those with annual income exceeding $100,000, even more skewed than the 84 percent of overall income taxes paid by such taxpayers, who represent about 20 percent of the total number of tax filers. And looking at individuals with higher income, those with more than $200,000 in income (about 6 percent of taxpayers), they paid about 86 percent of total quarterly estimated payments in tax year 2019.