Posted on February 1, 2021

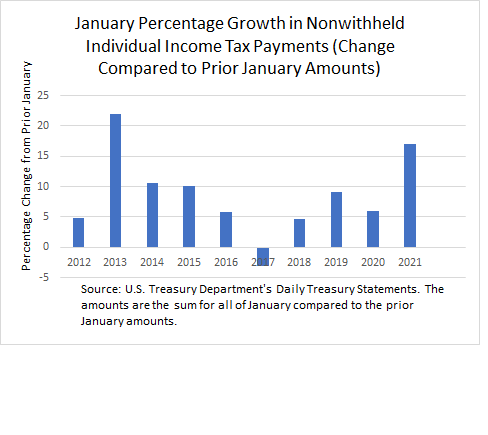

According to the Treasury Department’s daily tabulations, individual nonwithheld receipts in January–consisting largely of the last quarterly estimated income tax payment for 2020–grew by about 17 percent compared to the amount in January 2020. That is the highest January growth since 2013 (see chart below). A significant factor behind the strong growth in 2013 reflected income shifting, and the same phenomenon appears to be going on this year. Near the end of 2012, tax law was set in place stipulating that in 2013 higher-income taxpayers would be paying higher tax rates on capital gains, dividends, and ordinary income. Many affected taxpayers thus accelerated income into the lower-tax year of 2012, thereby requiring higher quarterly estimated payments in the subsequent January and higher payments with tax returns in April. This year the story is not quite as clear, but certainly after the presidential election higher-income taxpayers were on notice that their tax rates could well be rising in 2021, and some presumably protected themselves by accelerating income into 2020.

In a year like we had in 2020, nontraditional factors could also have contributed to the strong nonwithheld payments in January. For example, many people received unemployment benefits, which are taxable at the federal level, and didn’t have tax amounts withheld against those benefit payments. If those individuals made substantial quarterly tax payments in January, that could also have moved the needle on nonwithheld payments.

The strength of nonwithheld payments this January might be even greater than is evident in the daily data because the IRS may still be counting the final amount of money sent to it. Because of either slow mail delivery or staffing and processing difficulties at the IRS–all reflecting the challenges of operating during a pandemic–nonwithheld receipts at the end of January still had not quite reached “frictional”–that is, normally small–amounts. In every business day of the year there are at least small amounts of nonwithheld receipts collected by the Treasury, reflecting back taxes or other delayed or unusually-timed payments, but at the end of January receipts had not quite reached those small amounts. In all the other years back to 2011 that I’ve tracked, nonwithheld receipts reached those small amounts at least a couple of days before the end of January.

So, individual taxpayers made a hefty amount of January estimated payments. Unfortunately, I’ve never been able to draw much connection between the amounts of those nonwithheld payments in January and the amounts taxpayers pay during the subsequent tax filing season. For that, we need to wait.