Posted on February 7, 2020

The Bureau of Labor Statistics reported in its January employment report that nonfarm payroll jobs increased by 225,000 in January from the amount in December, and the unemployment rate inched up 0.1 percentage points to 3.6 percent, still a historically low rate. The increase in jobs in January was well above the average monthly gain last year and was much more than analysts expected for the month. Although the data are subject to revision, it certainly looks like a good employment month.

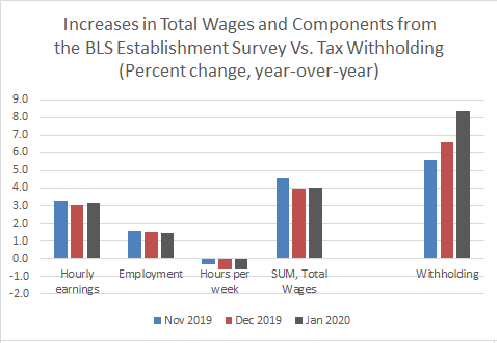

But let me focus on the part of report that measures increases in total wages and the components, and compare that to increases in total tax withholding.

The main takeaway is that tax withholding growth, I estimate, accelerated in December and January (see previous post), while wage growth in the establishment survey has moved down over the past two months, both measuring the increases compared to the same months of a year ago (see chart). Wages and withholding tend to move together, but they have diverged in the past couple of months. For two reasons I think the discrepancy is most likely caused by the measurement of average hourly earnings: First, the withholding data include bonuses and other irregular income, which are important in December and January, while the BLS establishment survey explicitly does not include that income. Second, hourly earnings are simply the biggest and most variable part of wage increases, rather than increases in the number of jobs or the typically small change in hours worked per week. (I leave you with the algebra problem of proving that total wage growth is the product of the growth in average hourly earnings, weekly hours per job, and number of jobs.)

So, we had the estimate of accelerating withholding growth before the employment report showed the unexpectedly strong jobs growth in January. I plan to investigate whether the tax withholding data, which are available before the employment report for a month, can add information to analysts’ expectations of jobs growth. It’s a complicated assessment for a number of reasons, including the use of month-to-month changes in employment and year-over-year measures of withholding growth. But if the tax withholding data add information, that would be important if only because unexpected movements in the employment report move financial markets. While I’d be tempted to say that this month the withholding data “won” and predicted the jobs increase in January that was above analysts’ expectations, I’d be hesitant to say that for several reasons: most importantly the January withholding is volatile because of bonuses, which are not related to employment. But that doesn’t mean, if you’ll excuse the double negative, that none of the pickup in withholding was due to a pickup in employment.