Posted on January 31, 2020

Hello and welcome. This is the inaugural post on the taxtracking.com blog. Let’s jump right in.

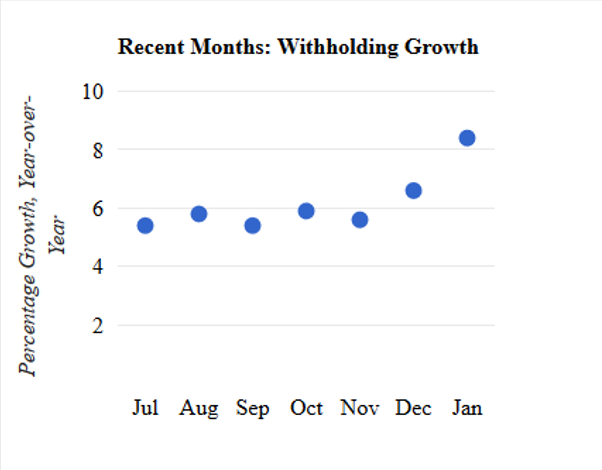

I have been surprised by recent withholding data—far from the first time and certainly not the last. In short, withholding growth appears to have accelerated in December and January from growth in previous months. A step back first: we look at employer tax withholding from paychecks, as reported daily by the Treasury Department, for the combined amount of income and payroll taxes, with growth measured on a year-over-year basis (that is, this year’s dollar amounts compared to the amounts in the same period a year ago). Withholding growth as I measure it (see methodology page) had been growing in a very narrow band of 5 percent to 6 percent from July through November, but then growth moved up a percentage point in December, to 6.6 percent, and then even more in January, to 8.4 percent.

Although economywide wages tend to move with withholding (see quarterly chart) , there is no good evidence yet of a major acceleration in wages. Movements in withholding growth off trend in December and January are usually temporary. Withholding growth in those months can bounce around as a result of year-end bonuses—with the traditional bonus season starting in December and continuing into January. Also, measurement of growth in withholding is harder in those months as a result of the multiple holidays. It is even possible, although it happens only very infrequently, that the Treasury Department will identify significant misallocations in its daily reports for withholding and will adjust the monthly totals in its data release in February of monthly revenues and outlays for January.

It is difficult to identify possible sources of an acceleration of withholding in the past two months. Reports indicate that year-end bonuses on Wall Street, a major source, are lower than last year, not significantly higher as would be consistent with the withholding data (see Forbes). In addition, increases in the minimum wage in numerous states in January shouldn’t have big economywide effects (see Economic Policy Institute). Also, new W-4 forms required for employees starting a new job in January shouldn’t have a big immediate effect.

We’ll see at the end of next week what the Bureau of Labor Statistics (BLS) employment report for January says—you know, the monthly report with the unemployment rate and job growth, but also with lesser-reported information on wages. Wage growth reported by BLS reflects changes in three identified components: employment, hours worked per employee, and average hourly earnings. Although the withholding data certainly don’t suggest weakness in any of those components for January, I wouldn’t overinterpret the implications of the past two months of strong withholding data. Year-end, one-time bonuses are even excluded from average hourly earnings in the BLS measure.