Posted on July 3, 2020

Summary

- Yesterday’s employment report for June from BLS showed a clear improvement in economywide wages and salaries, which was in line with what we were seeing through the course of June in daily tax withholding.

- Withholding and wages have a long way to go to return to pre-pandemic levels. Withholding has retraced less than one-fifth of its decline through April, and wages as measured by BLS have retraced about one-third of the decline.

- The very partial recovery in the economy to date, and the clear concerns that very long-lasting or permanent job losses may be large in number, point to the need for additional policy actions to mitigate the effects on individuals and families and to support continued economic recovery.

- We have not observed any weakening in withholding in the second half of June, although there are concerns that the BLS establishment survey, the basis of much of its employment report, was undertaken in mid-June, before growing COVID-19 infections in many states caused some restrictions to be reimposed.

Yesterday the Bureau of Labor Statistics (BLS) released its estimates of employment and wages for June, and both measures showed clear improvement, though there is still a long way to go to get back to pre-pandemic levels. The improvement in economywide wages was consistent with what we were seeing through the month of June in daily tax withholding, which is released each day by the Treasury Department and synthesized by us. Tax withholding, being based on the amount of economywide wages, correlates well with different measures of economywide wages; we do, however, need to adjust the withholding amounts for the estimated effects of tax law changes that affect withholding but not wages, an adjustment that affects about one-third of the period since our withholding growth measures begin in 2005.

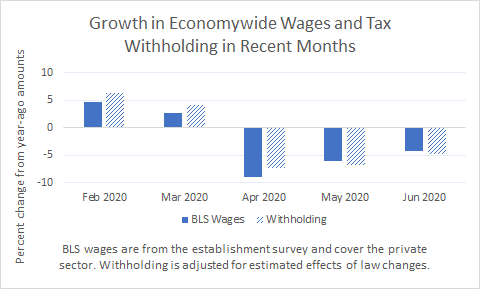

Specifically, BLS-measured wages, which cover the entire private sector and come from a monthly survey of establishments, were down by 4.3 percent in June compared to the amount in June 2019 (so-called “year-over-year growth”), which was a clear improvement from the 6.1 percent decline in May and the 8.9 percent decline in April, at the worst of the downturn (see chart below). Withholding growth on our tax-law adjusted basis (see methodology) was down by a very similar 4.9 percent in June, with a very similar improvement from a decline of 6.9 percent in May. Withholding had not dropped as much in April, at 7.3 percent, as did the BLS measurement of wages.

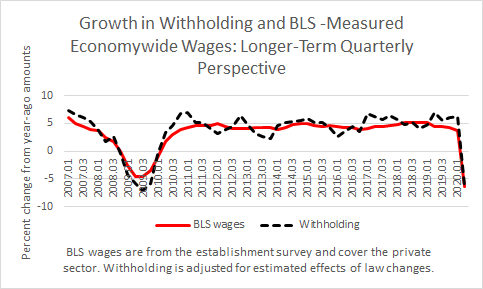

Over the longer term, our tax-law adjusted measure of withholding growth has broadly moved with BLS-measured wages and salaries (see chart below). Withholding has tended to be more variable in part because of year-end bonuses, which are excluded from the BLS wage measure, and because of so-called real bracket creep, where in a growing economy wage increases tend to push more income into higher tax brackets (and the reverse tends to occur in recessions). Because of real bracket creep, tax withholding growth tends to be a bit larger than wage growth in a growing economy. Note that there a variety of different measures of economywide wages at either a quarterly or annual frequency that are available with much longer lags than the BLS-measured amounts that come from the monthly establishment survey. Several of those other economywide wage measures–such as from tax returns, W-2 tax reporting, or administrative data from unemployment tax reporting–are probably better gauges of wages. The long lags in availability, however, hamper their ability to inform policymakers of short-term fluctuations like we are now seeing.

On a monthly basis, both wages and withholding have retraced part of the decline since April, but there is still a long way to go to get back to pre-pandemic levels. Year-over-year growth in tax withholding in June was a little less than one-fifth of the way back to its February amount, and growth in BLS-measured wages was about one-third of the way back.

There are clear concerns that jobs related to shorter-term furloughs are the ones largely being reclaimed first, and that permanent or very long-lasting job losses may be large in number. That adverse outcome, and the very partial recovery in the economy to date, point to the continued need for policy actions to mitigate the effects on individuals and families and to support continued economic recovery.

There is also a concern that the BLS establishment survey for June was, as always, undertaken in the middle of the month, which in this case was before growing COVID-19 infections in many states caused some restrictions to be reimposed. Continued unemployment insurance claims in the third week of June increased slightly from the prior week, rather than continuing the downtrend observed since early May. We have not, however, observed any weakening in the daily withholding amounts through the course of the second half of June.