Posted on July 18, 2020

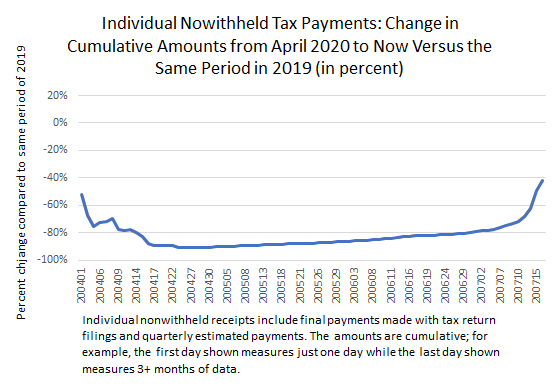

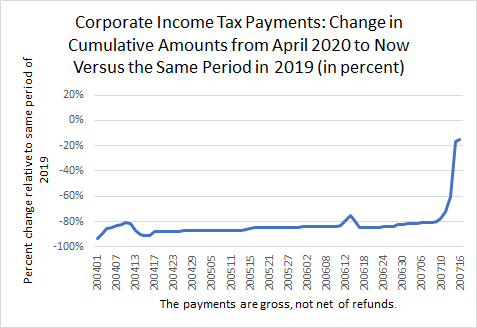

Federal revenues were very low from April to June, mainly because the Treasury Department allowed individuals and corporations to delay until July 15 remitting amounts for income taxes otherwise due during those three months. Now that July 15 has passed, daily tax receipts are showing a major rebound, with more to come through the end of July as the IRS continues to count the money from checks remitted with filings of individual income tax returns. Over the April to June period, nonwithheld individual income tax receipts and corporate income tax receipts were both down by about 80 percent compared to the same period in 2019, but including receipts recorded so far this month (so measuring from April through now), both revenue sources have rebounded substantially (see charts below). Unlike individual nonwithheld receipts, corporate receipts should not recover much more this month, because most payments have been booked. More details follow.

What were the allowed payment delays? First, individuals and corporations were both allowed to delay for three months, until July 15, filing their income taxes for 2019 and paying any amounts due. In addition, both individuals and corporations could wait until July 15 to make their first two quarterly estimated tax payments for 2020, which were originally due, as usual, on April 15 and June 15. (For corporations, those original due dates apply only to those who operate on a calendar year accounting basis, which are most corporations. Firms with other accounting years with income tax payments due between April and June were also allowed to delay making those payments until July 15.)

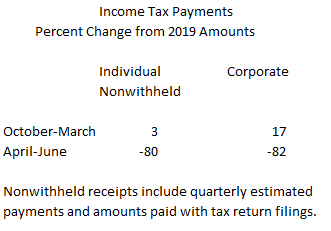

We can break federal revenue performance this fiscal year into the pre- and post-pandemic periods. From October 2019 to March 2020, the first half of the current federal fiscal year, tax receipts were generally higher. Individual nonwithheld receipts–consisting of quarterly estimated payments and amounts paid with tax return filings–were up by 3 percent compared to the same period in the prior year (see table below). From April to June, however, those receipts were down by 80 percent, mainly because of the allowed payment delays. Corporate receipts (the gross payment amounts, not net of refunds) were higher by 17 percent in the October-March period, but similarly down by 82 percent from April to June.

Now with the July 15 payment deferrals having ended, revenues are rebounding. Individual nonwithheld income taxes from April through Thursday, July 16, the last day for which daily receipts are available, were down by 42 percent compared to year-ago amounts (again, see the charts above). That is a big improvement from being down by 80 percent, and we can expect much more recovery through the end of the month as the IRS finishes counting the money from checks mailed in with tax returns. Corporate receipts from April through July 16 were down by about 15 percent, an even bigger improvement, although not much more recovery should be expected this month because the large bulk of corporate receipts stem from electronic payments and have been quickly recorded. Given the sharp downturn in economic activity in recent months, a decline in corporate income tax payments is no surprise.

We’ll continue to track these daily receipts through the end of the month.