Posted on April 18, 2021

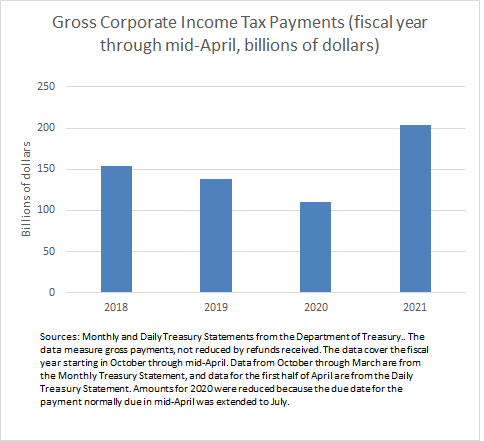

Corporations paid a surprisingly (to me) large amount of income taxes in mid-April. For the majority of firms whose accounting is done on a calendar year basis, mid-April (Thursday of last week this year) is the due date both for quarterly estimated payments for the first quarter of the current year and for final payments for the prior year. For this month through April 15, corporations paid over $72 billion of income taxes to the Treasury, compared to $47 billion in the same period of 2019 and $43 billion in 2018. Little was paid in April 2020 because the due date was extended to mid-July as a result of the pandemic. So, payments this April have been very strong (and only small amounts should come in during the remainder of the month), and when combined with relatively high payments earlier, the amounts for the fiscal year-to-date are well above the amounts for the comparable periods in 2019 and 2018 (see chart below). Indeed, amounts paid by corporations so far this fiscal year are about 47 percent above payments in the same period of 2019, before the pandemic and recession. That suggests that corporate profits economywide have recovered well from the recession.

Nothing is ever simple with corporate income taxes, and a more complete picture would look at refunds as well. It could be that profitable firms are doing very well, and their tax payments are way up, but other firms have been significantly hurt by the recession, as the pandemic has clearly provided opportunities to some but much pain to many others. Those hit hard in 2020 could be due for refunds at some point, as the CARES Act enacted last March allowed firms with losses in 2018, 2019, and 2020 to carry back their losses for up to five years to receive refunds of past taxes paid. We’ve discussed corporate refunds before (see previous post), but so far this fiscal year corporate refunds have not been growing as fast as one might expect given the CARES Act provisions, in particular the allowed retroactive carrybacks for tax years 2018 and 2019. Corporate income tax refunds through March of this fiscal year were $26.5 billion, more than the $21.7 billion in 2020 and $22.6 billion in 2019 for the comparable period, but not that much more; we are still waiting to see the refunds anticipated by the cost estimate of the Joint Committee on Taxation done at the time of enactment of the CARES Act ($87 billion over fiscal years 2020 and 2021). A recent report by the General Accountability Office indicates that $11 billion of such refunds had gone out to corporations by the end of December 2020, with more to come as the IRS deals with the backlog of refund requests that occurred in large part because the IRS’s ability to function was impaired by the pandemic. We’ll see if corporate refunds pick up in coming months and make a substantial dent in what otherwise is looking like a very strong year for corporate income tax collections.