Posted on May 28, 2021

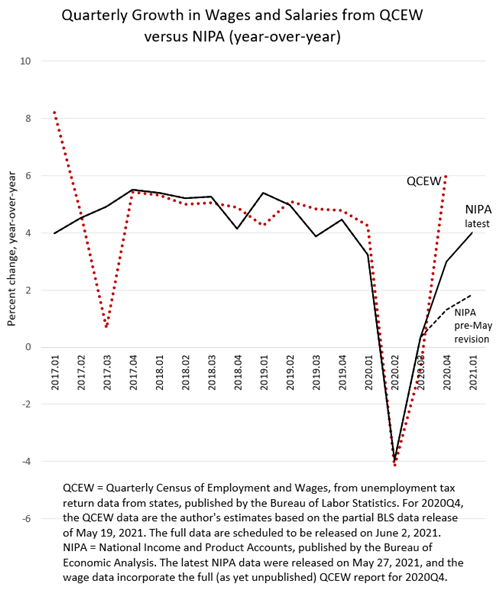

Just a quick note as we wait for more complete data next week. But yesterday the Bureau of Economic Analysis (BEA) revised wages and salaries for 2020Q4 up from 1.3 percent growth compared to the same quarter in 2019, to 3.0 percent growth (see chart below). That revision in the National Income and Product Accounts (NIPAs) was made for consistency with new data from the Quarterly Census of Employment and Wages (QCEW). Though the NIPA revision was significant, it wasn’t as much as we had expected (see post from last week) based on our reading of the QCEW data that wages measured in the report, which eventually form the basis for the NIPA estimates, grew by 6.2 percent on that year-over-year basis. We hadn’t expected that NIPA wage growth would be revised up to the full 6.2 percent growth shown in the QCEW data, but we did expect more than a 1.7 percent upward revision. We’ll be able to say more after the full QCEW report for 2020Q4 is released next week, but it almost appears that BEA is interpreting the strong QCEW data for 2020Q4 as partly influencing 2021Q1, which was revised up by a bit more in the NIPAs, from 1.8 percent growth pre-revision to 4.0 percent now. That sort of change would be consistent with BEA interpreting some of the strong 2020Q4 QCEW data as being from seasonal or business day factors, which they neutralize in 2020Q4 but carry over into their estimate for the first quarter of 2021. Normally, though, I’ve found that those seasonal or business day factors don’t span calendar years (see for example, 2017Q1 and 2017Q3 in chart below). After the full QCEW data are out, for the fuller story I’ll try to go back and see if deviations between QCEW and NIPA quarterly wage growth span calendar years. Based on the close relationship between annual growth in wages as measured by the two sources, I don’t expect to find clear year-spanning deviations, at least not recently. Stay tuned and I hope you have a good Memorial Day weekend.