Posted on August 1, 2020

On Thursday of this past week the Bureau of Economic Analysis (BEA) released its first estimate of economic activity for the second quarter of this year, garnering big headlines, but they also released their lesser appreciated annual revisions to the National Income and Product Accounts (NIPAs) that go back several years. I’ll focus on the revisions, which are especially important for macroeconomic forecasters and for those who project federal and state tax revenues.

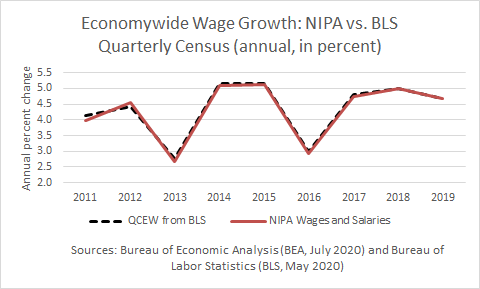

The most important revisions for revenue estimating purposes are wages and salaries and corporate profits. First wages and salaries: for 2019, BEA’s estimates of economywide wage and salary income were virtually unchanged from their prior estimates. That was no surprise, as we expected that outcome when we posted back in May, after the main underlying data became available. Quarterly wage data from the Bureau of Labor Statistics, based on data provided by employers for purposes of administering the unemployment tax system, line up very closely with what BEA will later release (see chart below). The BLS data are available almost 5 months after the end of each quarter, so we had all of 2019 data in May. (We don’t include on the chart the data before the recent revision because they would be virtually indistinguishable from the other lines.)

As well as we can predict wage and salary revisions, we cannot predict BEA’s revisions to its estimates of corporate profits. BEA this past week raised the estimates of corporate profits by about 5 percent for 2017, growing to 8 percent for 2019 (using the profit measure with capital consumption and inventory valuation adjustments, for the record). At $175 billion for 2019, that revision is very significant. The main data source for profit revisions comes from corporate income tax returns, which is a better source than the financial statement data used in the meantime. Those tax data become available from IRS with long lags, as all corporate tax returns aren’t even required to be filed for more than a year after the calendar year ends, and then the IRS must process the data. This past week BEA used data from the 2017 corporate income tax returns to revise the profit data, using unpublished data from the IRS.

Part of our difficulty in anticipating the profit revisions is that in the past few years, IRS hasn’t publicly released the aggregate information from corporate tax returns (from 3 years prior) before the annual NIPA revision in July; before then IRS generally did, but they have been dealing with a significant lack of funding in recent years, and that has affected their compilation and release of tax data. They have been catching up in publicly releasing the corporate tax data, so we’ll see if they have released the data for 2018 by the middle of next year–and they’ll need to release the 2017 data first (which is scheduled for late September). But the rest of our difficulty in foreseeing the BEA profit revisions is that even when the corporate tax data are available, there are multiple adjustments that BEA makes to the profit data to make them conform to BEA’s measurement definitions. And those multiple adjustments are very difficult to project. So, don’t expect any close projections from me on future NIPA profit revisions.