Posted on September 27, 2020

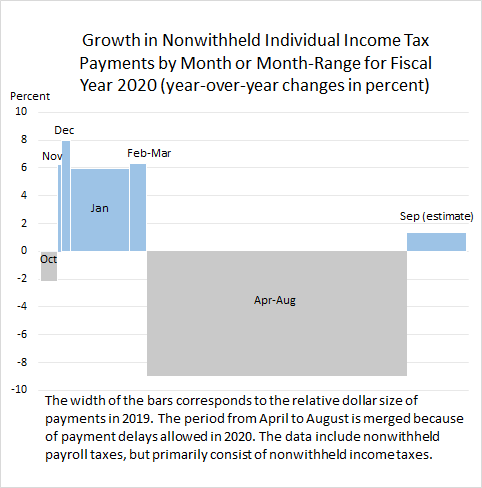

Well, it’s not by a lot, but based on the Treasury Department’s daily tax data through September 24, we estimate that nonwithheld individual income tax payments in September have increased compared to those in September of a year ago. Those payments, which largely represent the third quarterly estimated payments by individuals for the current tax year, have risen by about 1 percent above those from last September at this same point in the month. The daily amounts have trailed off in recent days to the extent that it appears that the the Treasury Department has concluded processing nearly all such payments for the month, but there still could be some amounts to book. It seems more likely that some late-counted payments this month will boost that growth slightly compared to last year’s amount rather than reduce it. In addition, the increase might have been even greater without the effects of certain revenue-reducing provisions enacted in the CARES Act in March. The increase contrasts with a decline of about 9 percent in nonwithheld payments over the April-August period, which included not just two quarterly estimated payments (normally due in April and June) but also the large final payments of taxes with tax returns for 2019 (see chart below). In the other direction, the increase in September contrasts with larger increases in months immediately before the pandemic–generally in the vicinity of six percent–including the big January estimated payment.

An increase in quarterly estimated payments, even by a small amount, is a good sign given the terrible hit to the economy from the pandemic, but the increase reflects a limited part of the economy and it’s hard to draw many conclusions from just one quarterly payment. The Treasury Department doesn’t provide detail on individual tax payments other than whether they stem from tax withholding from paychecks or from all other sources–hence the name “nonwithheld” payments–that mainly consist of final payments with tax returns and quarterly estimated payments. The quarterly estimated payments include amounts from partners of partnerships and from sole proprietors on their business income; from individuals with capital income from dividends, realized capital gains, and interest income; and from retirees on income from pensions and distributions from previously untaxed amounts in retirement accounts. Those quarterly payments can even include amounts paid by individuals on unemployment benefits–indicating the opposite of strength in the economy–if the recipients elected not to have income tax amounts withheld from the benefit payments or did so elect but have taxable income from other sources, such as from a spouse, that make the default 10 percent federal withholding rate on unemployment benefits insufficient to cover the additional tax liability. Looking at all of those sources of quarterly payments, much accrues to individuals with relatively high incomes. To that extent, the small increase in quarterly estimated payments probably does not reflect a broad-based increase in taxable incomes across taxpayers in the economy.

Because the nonwithheld payments from April through August include both final payments with tax returns and quarterly estimated payments, we cannot tell if the quarterly payment component was already up in recent months. Normally we would observe nonwithheld payments in June and know that they largely reflected the second quarterly estimated payment for the tax year, but this year individuals were allowed to delay until July 15 three major payments: their final payments with tax returns normally due in April, the quarterly estimated payment also normally due in April, and the quarterly estimated payment normally due in June. Even nonwithheld payments in August could be affected by the payment delays because some final payments with tax returns normally get processed and counted in the next month. Therefore, for analytical purposes we merge nonwithheld payments this year from April through August to provide an apples–to-apples comparison with receipts last year.

It seems unlikely that the quarterly payment component of nonwithheld receipts was up during the April-August period compared to year-ago amounts, mainly because that would imply that final payments with tax returns were down by more than the 9 percent decline registered for all nonwithheld payments. There was nothing about 2019 economic activity I am aware of that suggests a big drop in final payments with tax returns, but that can’t be ruled out given the large volatility in those payments from year to year.

One encouraging item is that estimated tax payments in September may have been depressed by law changes enacted in March, meaning that the incomes associated with the tax payments may have grown by more than the growth in tax payments. One of the main such law changes, which we posted about last month, allowed individuals with substantial business losses (amounts more than $250,000 for a single taxpayer, or $500,000 for a joint filer, called “excess business losses”) in 2018, 2019, or 2020 to once again immediately claim those losses against non-business income for tax purposes–as they had been allowed to do until tax law changes enacted in late 2017 allowed the excess losses to only be carried forward to future years. How much those law changes affected different types of tax payments and refunds will probably never be known.