Posted on May 6, 2024

Summary

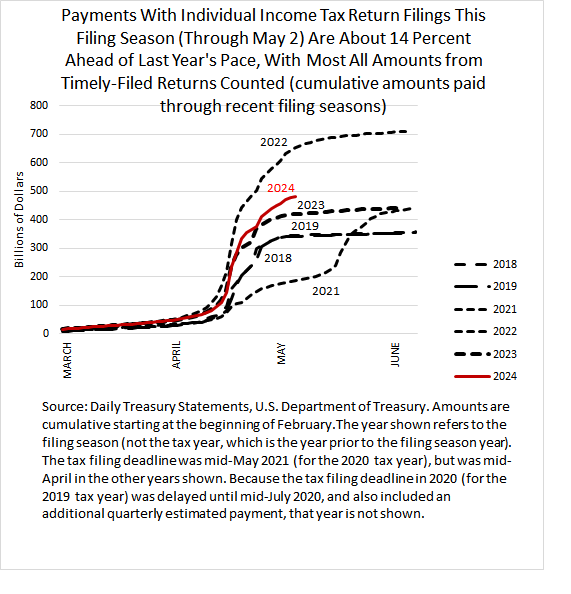

- As the counting of income tax payments with timely-filed tax returns in April comes close to an end, we estimate that such payments are up by about 14 percent over last year’s amounts, a significant increase.

- That increase suggests that nonwage incomes increased strongly in 2023.

- Overall tax revenue through the federal fiscal year-to-date, with almost five months remaining in the year, are up by about 10 percent over last year’s amounts at the same point in the year.

- Extrapolations of revenues by type of tax for the rest of the fiscal year, based on growth in recent months, suggest that revenues could be up between 10 percent and 11 percent for the full fiscal year, close to the growth of 11 percent to 12 percent projected earlier this year by revenue estimators at the Treasury Department and the Congressional Budget Office. Revenues for the rest of the fiscal year could certainly move up or down relative to our simple extrapolation as overall economic conditions change.

Although the IRS’s final count of income tax payments with timely-filed tax returns is not quite complete, it is clear that payments are up significantly over last year’s pace: higher by about 14 percent, with the potential for it being a little higher than that when all the counting is complete (see the chart below). That growth doesn’t get such tax receipts up to anywhere close to the amount from the filing season of two years ago, when the significant increase in the stock market and economic recovery in tax year 2021 boosted payments by more than 60 percent in the 2022 filing season over the prior year’s pace. Tax payments fell substantially last year from the elevated 2022 amounts, but the bounce back in this filing season is indicative of significant increases in the 2023 tax year in nonwage income–such as realized capital gains, business income from passthrough entities (such as partnerships, S corporations, and sole proprietorships), and interest and dividends. It takes time for the tax returns to be fully processed and for the aggregate income and deduction data from those returns to become public; indeed, many taxpayers with substantial income and tax payments don’t even need to file their returns until mid-October, receiving an automatic filing extension that is available to all taxpayers (though they did need to estimate and pay amounts due by mid-April).

The significant increase in individual income tax payments with tax returns, along with some strong corporate income tax payments in mid-April, have boosted overall federal tax receipts during this fiscal year. In federal fiscal year 2024 through May 2–with the fiscal year beginning on October 1, 2023–we estimate that total federal revenues are higher by about 10 percent compared to revenues at the same point last year (see the chart below). Through April, not taking into account the first couple of days of May, we estimate that revenues were higher by about 11 percent. Until the mid-April payments came in, revenues for the year-to-date since February had been running about 7 percent above the prior year’s amount.

When I do some simple extrapolations of revenues by type of tax for the remainder of the fiscal year, based on growth rates in recent months, I get total revenue growth for the full fiscal year in the 10 percent to 11 percent range. That is subject to much uncertainty, given that over the next five months tax receipts can certainly move up and down with the economy. Nonetheless, that would put revenue growth pretty close to the amounts projected by federal revenue estimators at the Treasury Department and Congressional Budget Office (CBO), which earlier this year projected growth of almost 12 percent (Treasury, from early March) and a little over 11 percent (CBO, from early February), both assuming no tax law changes in the remaining months of the fiscal year. Lower-than-expected cash receipts were cited by the Treasury Department at the beginning of last week as contributing to a boost in their quarterly financing needs. Considering that some of the strength in payments with tax return filings occurred last week, I wonder if the financing needs have improved some since the Treasury’s announcement.