Posted on April 24, 2023

Federal tax payments with individual income tax return filings are running well behind the 2022 pace at this same point in the processing. By our tally, payments are lower by about one-third (see the first chart below) compared to the 2022 pace. Normally at this point there is not an overly large amount of revenues still awaiting IRS processing: typically around two-thirds of total payments with tax returns are counted by now. Most all electronic payments look to be counted, and they are down by between 35 percent and 40 percent compared to last year at this point. Still to be counted are amounts mailed to the IRS around the April 18 tax deadline and that await processing. So far the mailed-in payments have not been down as much as the electronic payments. But given the weakness in electronic payments, it is hard to see how the amounts from the mailed-in payments can erase a substantial part of the overall shortfall relative to last year. We should know over the next week or two. Unless revenues unexpectedly turn around in the final counting, we should expect the federal debt limit to bind on the earlier side of the prior government-estimated range in which the date could be as early as in June.

It is possible that there is a delay in some payments as a result of filing deadline relief granted by the IRS to taxpayers in parts of the country affected by disaster situations in recent months, notably major parts of California but also some other parts of the country. The payment and filing delays last until October for parts of California and as early as mid-May in other parts of the country. But historically amounts delayed for such reasons have not moved the revenue needle significantly, though this year the areas affected are larger than usual.

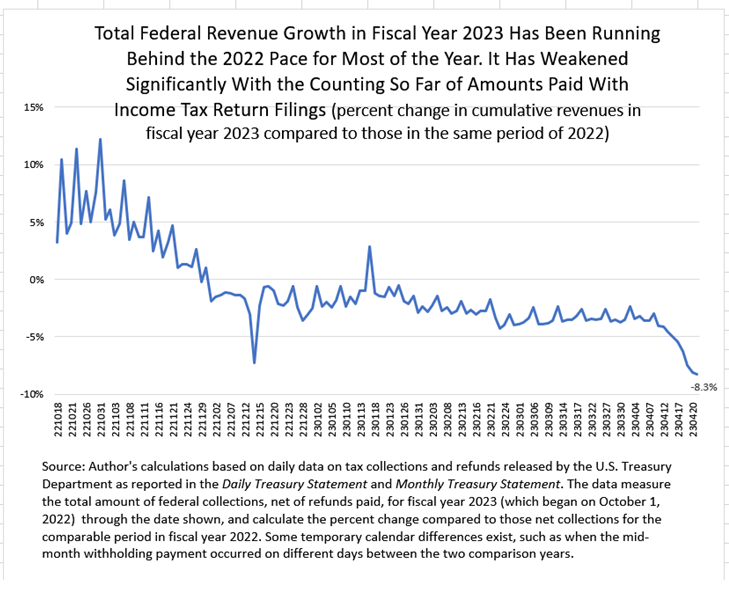

The sharp decline in recent federal tax payments compared to last year’s amounts is dragging down total tax revenue growth for the fiscal year-to-date. By our calculation, total revenues (from all sources) through April 21 are down by over 8 percent (see the second chart below) compared to the amounts in fiscal year 2022 at this same point. We’ll take stock of how the outlook for federal revenues looks for the full fiscal year after the last of the counting of the payments with tax returns filed by the April 18 deadline. If the recent weakness in such revenues persists through early May, I expect that we’ll be seeing some government re-estimates of the likely time when the federal debt limit will become binding–namely on the earlier side of the previously-estimated range.