Posted on February 8, 2023

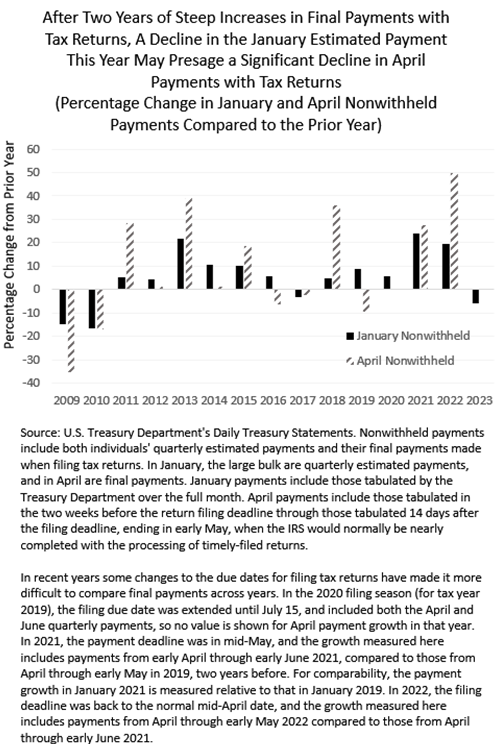

Payments made by individuals when filing tax returns jumped sharply in each of the past two years, but such payments may fall, perhaps significantly, this tax season. A possible harbinger is a decline in individuals’ quarterly estimated payments in January. Based on amounts reported by the U.S. Treasury Department, we estimate that total nonwithheld payments by individuals in January 2023 fell by about 6 percent, compared to the amount in January 2022, the first decline in the January payment since 2017 (see chart below). Nonwithheld receipts in January consist largely of the fourth and final quarterly estimated payment for the prior tax year, 2022 in this case; they can also include much smaller amounts of back tax payments from the 2021 tax year or earlier and potentially even some small amounts paid at the very end of the month with the earliest tax return filings for 2022. In April, nonwithheld payments normally largely consist of final payments with tax returns for the prior year.

The relationship between the January quarterly estimated payment and final payments with tax returns is not tight, but there is a definite positive correlation (again see the chart below). In the past 14 years before this one, we’ve observed three declines in estimated payments in January, and each time payments with tax returns fell in the following April. A small drop in estimated payments in January 2017 corresponded with a small drop in final payments with tax returns in April of that year, and more substantial declines in estimated payments in January 2009 and 2010 corresponded with even larger drops in April payments with tax returns in those years. Indeed those declines in payments with tax returns in 2009 and 2010, at 35 percent and 17 percent, respectively, were very large and contributed to significant declines in overall individual income tax receipts in those fiscal years during the financial crisis and its immediate aftermath. The very large stock market decline and drop in overall economic activity during the financial crisis caused capital gains realizations and business-related personal incomes to drop sharply. Those incomes are highly concentrated in higher-income taxpayers who pay the large bulk of quarterly estimated payments and, to a lesser extent, overall personal income taxes. A question is whether the smaller, yet very significant, drop in the stock market in 2022, without an economic recession, will also cause final payments with tax returns to drop, perhaps substantially, this tax filing season.