Posted on September 20, 2022

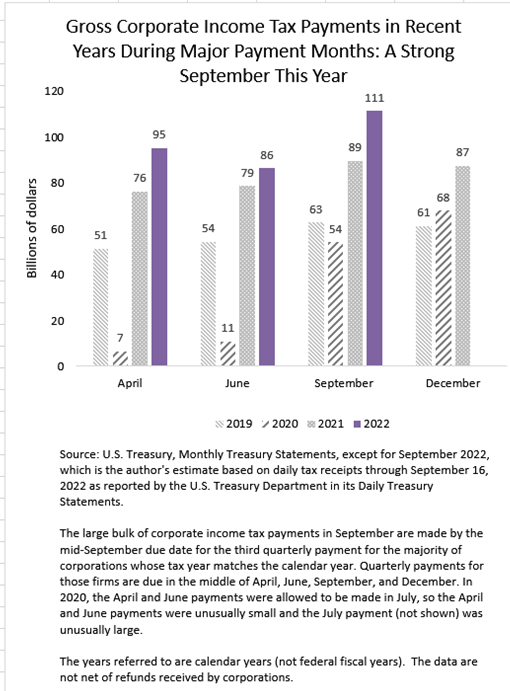

With the mid-September corporate income tax payments now in the books, and only relatively small amounts normally left to be counted over the rest of the month, we estimate that federal corporate tax payments for all of September will total roughly $111 billion, an increase of about 25 percent over the amounts recorded in September 2021 (see chart below). Receipts this past June, the previous major quarterly estimated payment month, were up by about 10 percent compared to the June 2021 amounts. We had interpreted that June payment as indicating that growth in corporate profits was slowing, but tax collections in mid-September suggest that corporate profits economywide at least are doing just fine and continuing to grow at a healthy clip.

Unfortunately, we only know the total amount of the tax payments, not the underlying sources. We can only guess that corporate profits are being boosted by inflation, especially in commodities (think oil and agriculture). More generally, the demand for goods has been outstripping the supply, and that causes an increase in prices and business sales. The increase in the amount of sales is not all gain to businesses, as they also have higher labor and other costs, but it appears that they have been passing much of those costs along to consumers.

Note that in mid-August the President signed into law the 2022 reconciliation legislation (unofficially called the Inflation Reduction Act of 2022), but we don’t believe that is having any effect on corporate tax payments in September. That legislation includes a new corporate alternative minimum tax on corporations with large amounts of financial statement income (adjusted in various ways), with the tax taking effect in calendar year 2023. I can’t think of any reasons why firms would respond to that legislation by recognizing taxable income now, in 2022, boosting their current tax payments; and in line with that reasoning, the Joint Committee on Taxation, the official scorer of tax legislation for the Congress, estimated significant revenues from the legislation beginning in fiscal year 2023, and none in fiscal year 2022 (that ends on September 30). So, it looks like corporate receipts may be difficult to interpret next year because of the legislation, but not this year.