Posted April 24, 2020

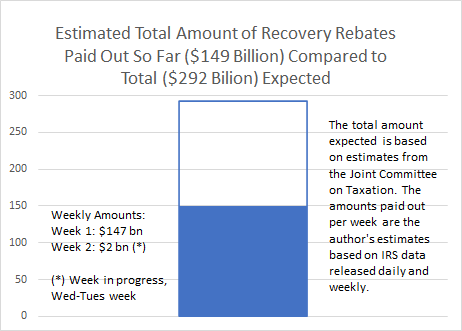

- I estimate that about $149 billion in rebates have been disbursed so far, just slightly over half of the total $292 billion expected by Congressional revenue estimators to eventually be disbursed.

- Almost all of the amount that has gone out has been directly deposited. I estimate that only about $3 billion in rebates have gone out in check form.

I thought I would try to estimate and track the amount of recovery rebates that have gone out to individuals versus the original estimates of how much would go out in total by the end of the disbursement process. We haven’t been getting detail yet from the Treasury Department or its largest bureau, the IRS, on how much has gone out in rebates (or what the IRS calls “economic impact payments”, as opposed to the “2020 recovery rebates” referred to in the law). So far, through Wednesday of this week, I estimate that about $149 billion in recovery rebates have gone out to individuals. That is just slightly over half of what I expect the total amount disbursed to eventually be, based on my reading of the estimates of the Joint Committee on Taxation, which were produced when legislation (the CARES Act) authorizing the rebates was enacted into law late last month (see chart below).

By my tabulations, the first rebates to show up in the Daily Treasury Statement were for Wednesday of last week, a big slug of roughly $147 billion in amounts directly deposited into individuals’ depository accounts. In the five business days since then, additional direct deposits appear to have been minimal (with a small amount actually subtracted, on net), but amounts disbursed in check form have been roughly $3 billion. There are certainly reports of some taxpayers already receiving checks in the mail, and Treasury has identified this week as when the first checks go out. Perhaps from here on out it is going to be almost exclusively rebates in the form of checks. Given the physical constraints in disbursing tens of millions of paper checks, it could take several months to complete the process.

For some technical detail on my calculations, the Treasury Department includes the dollar amount of recovery rebates along with other individual refunds, mainly from tax return filings, in what it reports as the dollar refund outflow every day in the Daily Treasury Statement. In order to estimate the amount of rebates, we subtract from those total daily refunds the amount we estimate as the non-rebate refunds, for which we use weekly filing statistics that IRS provides. Those weekly reports include only the non-rebate refund activity, and the amounts are actually disbursed and reflected in the Daily Treasury Statement with a lag. We estimate that there is a lag of roughly seven business days, so we use a Wednesday to Tuesday week for estimating the rebate amounts.

In past rebate programs in 2008, 2003, and 2001, the Treasury Department provided the daily breakout of the rebates from the regular refunds, but they haven’t been providing that detail so far this time. Given the unprecedented challenges related to COVID-19 that they’ve have to deal with, in particular the shutting down of IRS facilities, the precise accounting can wait. I’m sure we’ll get some reports from the tax authorities at some point. If anything, I would give the IRS much credit for getting so many rebates out so quickly under such extremely difficult circumstances. Nonetheless, many more refunds need to go out to taxpayers who need the funds greatly.