Posted on May 6, 2025

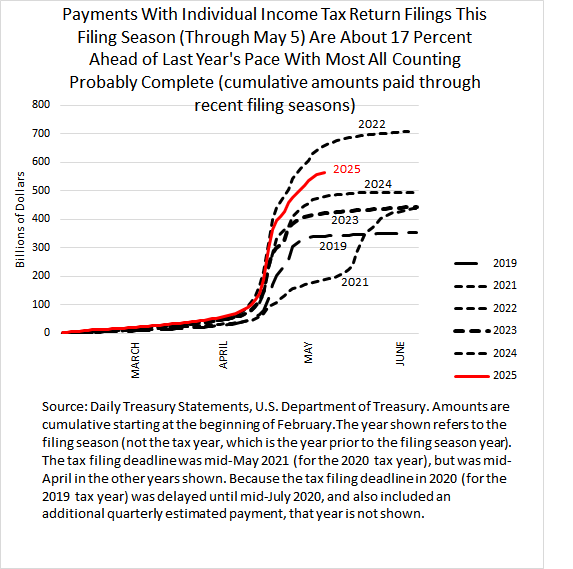

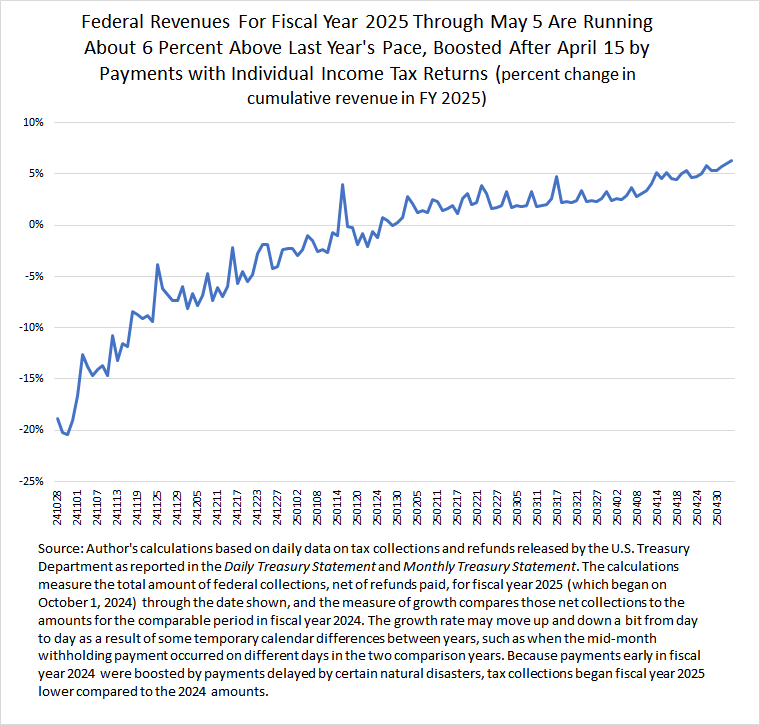

Large increases in federal collections from individual income tax return filings have boosted overall revenue growth. It appears that the IRS has completed most all of the counting of amounts paid with timely-filed tax returns for tax year 2024–mostly due by April 15, or by May 1 for taxpayers in large parts of the southeast affected by natural disasters last fall. We estimate that those payments with tax returns are up by about 17 percent compared with the same period last year (see the chart below). For the full filing season starting in early February, that is a gain of about $85 billion compared to last year’s amounts, or an extra $70 billion than if those collections with tax returns had grown at the 3 percent rate that overall revenues had been growing. We estimate that the extra amount has boosted total federal revenue growth up to about 6 percent for the fiscal year through early May (see second chart below). Higher revenues from tariffs in the past month, at about a $10 billion increase, have also contributed to the increase in total revenues, but much less than payments with tax returns. (The tariff collections though will accumulate, if the higher tariff rates continue.)

We had expected a boom year for payments with individual income tax returns because of the large increase in the stock market in 2024 and continued economic growth through the year. I don’t know if 17 percent growth in payments with tax returns qualifies as a boom year–we have certainly seen years with much larger increases. But clearly the cutbacks to date in personnel at the IRS did not cause a big decline in tax collections, as some sources at the IRS had reportedly anticipated. It is clear from the research that cutbacks in IRS enforcement funding cost the Treasury several times more in lost revenue collections than the amount of spending saved, but those revenue losses occur over an extended period rather than all at once.