Posted on July 22, 2020

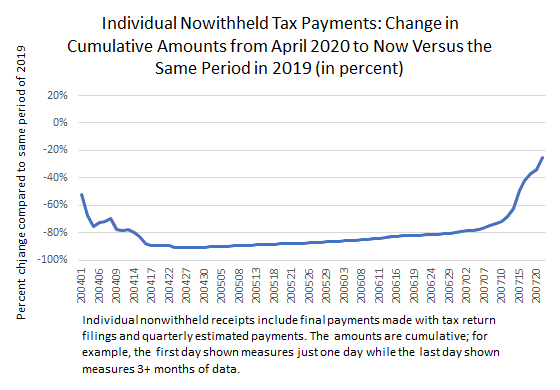

The IRS is still counting the money from checks that individuals mailed by the July 15 tax filing deadline, but we’re seeing the reversal of the effects of IRS administrative actions that allowed individuals to defer payments until July 15 that were originally due from April to June. Those deferrals included both payments with tax return filings for 2019 and the first two quarterly payments for 2020. Those so-called nonwithheld receipts from April through yesterday were down by about 25 percent (compared to the same period last year), which is a significant improvement from being down by about 80 percent from April through June (see chart below). Because the IRS has not completed processing the checks, the shortfall in collections relative to last year will only diminish further in coming days.

It’s possible that the shortfall in nonwithheld payments from April to June will be largely or completely eliminated by month’s end, but exactly how much money remains to be counted this month is always the question at this point in the IRS’s processing of tax returns. In April of 2009 and 2015, the last times that a tax return due date was on a Wednesday (like this year’s July 15), there was still a lot of money to be counted at this point in the month. For that calendar, yesterday, the Tuesday following the tax filing deadline, is typically the biggest money day, and we just learned that yesterday’s receipts were again quite large. In both 2009 and 2015 there was about 1.7 times the amount paid on that Tuesday still to be counted in the rest of the month. If that pattern continued this month–a big if considering we don’t know how well the pandemic-affected IRS is keeping up with processing and how the delayed filing deadline affects things–then we’d see the April-June shortfall reduced to the point where nonwithheld receipts from April through July would be down by about 10 percent. Clearly there’s a lot of uncertainty at this point. Given that historically about 70 percent of nonwithheld individual tax payments over the April-July period have been from income tax filings (which cover activity for the previous year), rather than from quarterly estimated payments (covering activity for the current year), that means that most the receipts should be unaffected by the pandemic; thus, it wouldn’t be a surprise if the shortfall through June were to be largely or completely erased by the end of July.

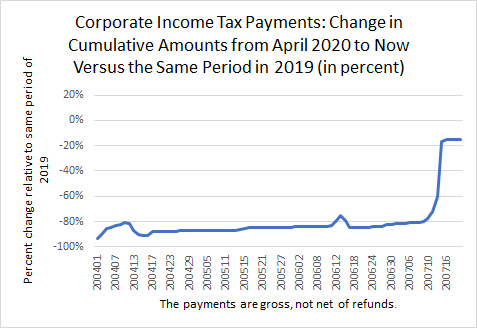

For corporate income tax receipts, which were also subject to significant allowed payment delays, the counting of payments this month is now pretty much over. Corporations were also allowed to defer payments originally due from April to June until July 15. Corporate receipts from April through yesterday were down by about 15 percent compared to the same period last year (see chart below). That is also a substantial improvement from the April-June period, when payments were (like individual nonwithheld payments) down by about 80 percent. That rebound hasn’t improved since we reported at the end of last week, and won’t likely improve much through month’s end. Corporate income tax payments are entirely made electronically and hence are counted more quickly than payments from individuals.