Posted on May 5, 2021

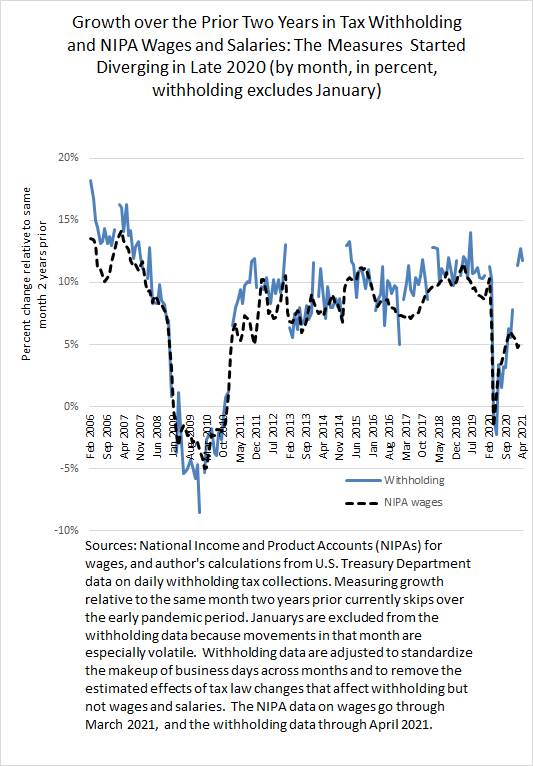

Here’s a post with just one paragraph and chart. (You’re welcome.) Since the end of 2020, we’ve measured a marked increase in growth of income and payroll tax withholding, but not nearly so much for economywide wages and salaries as measured in the National Income and Product Accounts (NIPAs, put together by the Bureau of Economic Analysis in the Department of Commerce). Measuring growth over the past two years–so currently back to before the pandemic–withholding growth in the past few months has averaged about 12 percent, while wages and salaries in the NIPAs have grown by less than half of that, about 5 percent over the past two years in February and March; the April wage measure isn’t available until late this month. In order to be a better proxy for economywide wage and salary growth, we calculate the withholding measure to remove the estimated effects of tax law changes that affected withholding but not wages, and we standardize the number and makeup of business days between months. Over a long period back to 2006, the two measures generally have moved together but with some exceptions including parts of the recovery from the Great Recession (see chart below). Because the recent NIPA monthly wage data are subject to revision, but with a long lag of at least five months, it will take some time to see if upward NIPA revisions to the recent data are in the offing. Recent withholding growth, however, may be somewhat overstated (relative to wage growth) because of the unequal effects of the past year’s recession and partial recovery on people with lower and higher incomes, in which higher-income individuals–who face higher income tax rates and pay a disproportionate share of income taxes–have fared much better (see previous post). That is unlikely to be the full explanation of the gap between withholding and wage growth. For example, withholding tends to grow more quickly than wages in a growing economy due to real-bracket creep, where equally-distributed (in percentage terms) increases in incomes tend to push more income into higher tax brackets. If the NIPA wages don’t get revised, then other factors would still need to be identified.