Posted on March 1, 2022

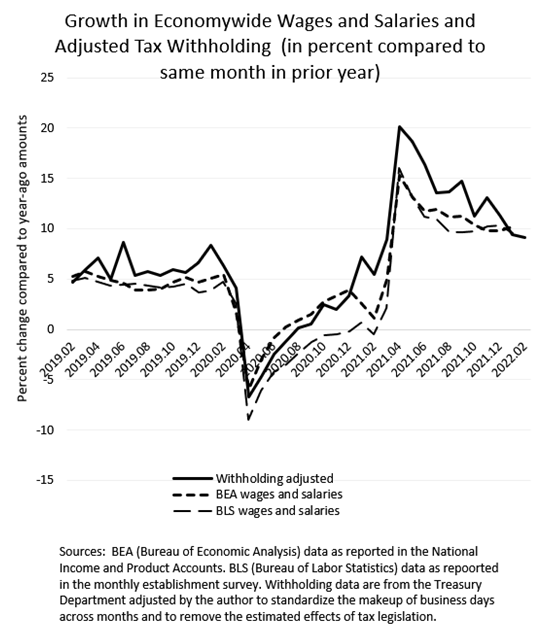

Tax withholding–amounts withheld from workers’ paychecks for income and payroll taxes and remitted daily to the U.S. Treasury Department–was up by 9.2 percent in February compared to February of a year ago, we estimate. Such year-over-year growth in withholding was about the same in January at 9.5 percent (see chart below). Those growth figures adjust the amount of withholding to standardize the makeup of business days across months (which can have big effects on reported amounts in a month) and to remove the estimated effects of tax law changes that affect withholding but not wages and salaries (currently a relatively small adjustment). Year-over-year withholding growth has been trending down in recent months, which is not a surprise as the economy has opened up more and more since April 2020 and each recent month’s withholding amounts get compared to a progressively stronger month of a year ago. If annual withholding growth remains near 9 percent in future months, that would be significantly higher than the roughly 5 percent to 6 percent growth registered pre-pandemic. Some or much of that recent gain, though, is presumably intertwined with the effects of inflation.

We think there are signs from the withholding tax data in recent months that wage growth of lower-income individuals has been exceeding that of higher-income individuals. In particular, direct measures of economywide wage growth had been lagging behind withholding growth for most of the past year, but the gap has closed very recently (again, see the chart below). Those economywide wage measures come from both the Bureau of Economic Analysis (BEA) in the U.S. Department of Commerce and the Bureau of Labor Statistics (BLS) in the U.S. Department of Labor. Withholding growth through most of the economic recovery had been above wage growth, we postulated, because wages of higher-income taxpayers, who face the highest tax rates and pay most of the income tax, had been growing faster than the wages of lower-income workers. But there was no gap in January between withholding and wage growth, and we don’t expect there will be much in February, either–although we need to wait for the direct economywide wage measures for February, which are also subject to occasional substantial revision. (The next BLS establishment report, for February, is scheduled to be released on Friday of this week.) That reading of movements in the wage distribution would roughly correspond with real-time income inequality measures produced by Thomas Blanchet, Emmanuel Saez and Gabriel Zucman at the University of California, Berkeley. According to their analysis, the recession hit people in the bottom 50 percent of the income distribution especially hard (no surprise there), but that group’s share of factor income (defined in the next sentence) has increased faster in the recovery than that of people in the top 10 percent of the distribution, so that the overall distribution of factor income is now back close to where it was before the recession. Factor income includes income from employment, income of self-employed individuals and partners from their partnerships, and corporate profits allocated especially to higher-income individuals who own the bulk of corporate shares. That real-time measure of factor income across income groups comes from a variety of sources, especially the Current Population Survey of the U.S. Census Bureau.

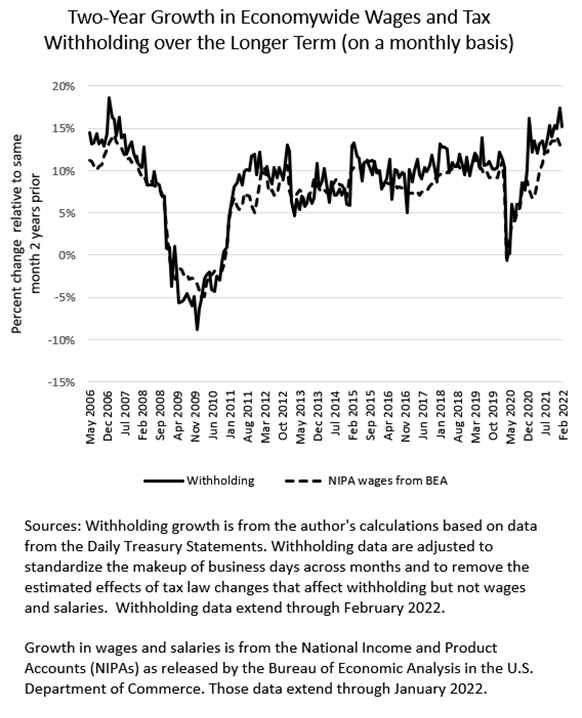

As a final point, our last useful monthly measure (for a while) of two-year growth in withholding taxes indicates that withholding amounts in recent months have been growing at a faster clip than they were pre-pandemic (see chart below). In recent months, withholding has been growing about 15 percent above amounts from two years ago, back before the pandemic. That is a good bit faster than the 10 percent to 12 percent two-year growth over most of the 2011 to 2019 period. Again, wages have been growing faster recently as a part of overall economic forces that have caused a significant pickup in inflation. The two-year growth assessment has been especially useful over the past year because the one-year growth has been hard to interpret with the downs and ups in the economy. But starting this month and especially in April, two-year growth rates will take a big jump up because the amount of withholding will be compared to the depressed amounts that began in March 2020 and then hit bottom in April 2020. We do not plan to start looking back three years to measure withholding growth relative to the period just before the pandemic and recession!