Posted on April 29, 2022

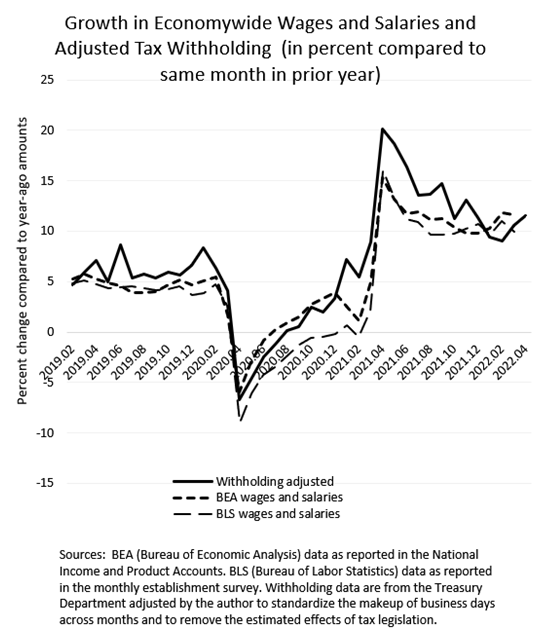

The amounts of federal income and payroll taxes withheld by employers from paychecks–what we call tax withholding–grew faster in April than in March, we estimate, after having grown faster in March than in February. The amount of tax withholding, which moves with overall wages and salaries in the economy, was 11.5 percent larger in April than in April of 2021 (so-called year-over-year growth), compared to 10.5 percent growth in March and 9.0 percent growth in February (see chart below). We construct that measure from daily reports released by the U.S. Treasury, but adjusted to remove the estimated effects of tax law changes that affect withholding but not wages and salaries (currently a relatively small adjustment) and to standardize the makeup of business days across months (see our methodology). Some of that faster withholding growth in the past couple of months could clearly be from the effects of inflation feeding back into wages, but the magnitude of the gains is large enough that we see no signal of a slowing of the labor market and overall economy. Other direct measures of wages and salaries–from the Bureau of Economic Analysis in its GDP Accounts and from the Bureau of Labor Statistics (BLS) in its monthly establishment report–have been growing in recent months at about the same clip as tax withholding, although those measures are not yet available for April. The BLS establishment report for April is scheduled to be released on Friday, May 6.