Posted on February 27, 2021

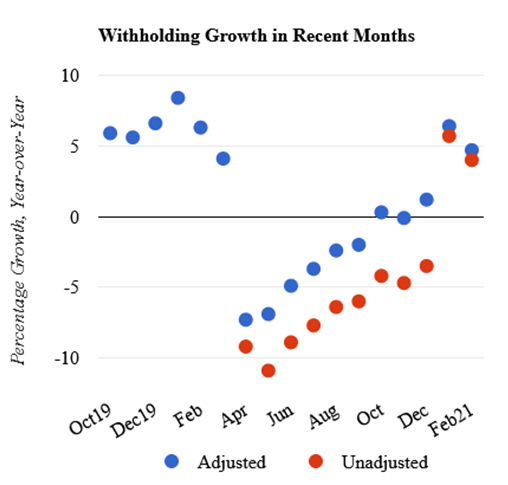

By our measure, income and payroll taxes withheld from workers’ paychecks and remitted by employers to the Treasury Department rose in February by 4.7 percent above amounts remitted in February 2020 (see chart below). That measure is adjusted to remove the estimated effects of tax law changes, but is a solid 4.0 percent even including the effects of tax law changes–the unadjusted series in the chart below. Tax withholding growth has improved markedly since late last year. Tax withholding, after removing the estimated effects of tax legislation, tends to move with wages and salaries in the economy, and the performance in February suggests a strengthening labor market economywide. We had observed in January a jump up in withholding growth to above 6 percent, but movements in January are often volatile and temporary as a result of year-end bonuses and measurement issues.

The importance of the February growth measure is that it is largely devoid of tax law effects, reducing the uncertainty surrounding our measure that we estimate on a constant law basis. The major economywide effects of the pandemic hit last March, and the first federal legislation in response was enacted in the middle of that month, with the most significant legislation, the CARES Act, enacted near the end of March; there were likely few effects of the March legislation until April. Starting in April, the adjustments we made to the raw withholding data to reflect the estimated effects of enacted legislation added uncertainty to our estimates; many of those law changes, however, expired at the end of calendar year 2020. In February and March of this year, we have a chance to observe the growth in withholding amounts (compared to year-ago amounts) largely absent any such legislative effects. (See a previous post for our current legislative adjustments.) We’ll see if March continues to show relatively strong withholding.

Also, the beauty of February, at least from an analytical perspective, is that it normally contains exactly 20 business days–28 total days consisting of 4 complete weeks; you’ve probably noticed. Even last year, a leap year, had 20 business days. That means that our adjustment to the withholding data for comparability of business days across years is not as necessary in February.

Indeed, the raw withholding amount this February, after the final business day of withholding remittances for the month is reported by the Treasury Department on Monday, looks like it will end up growing between a little over 3 percent and a little over 4 percent above last February’s amount. Then if we added on our 0.8 percent growth adjustment to remove the current revenue-reducing effects of law changes relative to last February (mainly the employee retention tax credit that is currently in effect), we would get into the 4 percent to 5 percent growth range on a constant law basis, like the 4.7 percent measure that we get with our methodology using representative periods during the month (see our methodology). Any way we slice it, February looks like a strong month for tax withholding.