Posted on August 31, 2021

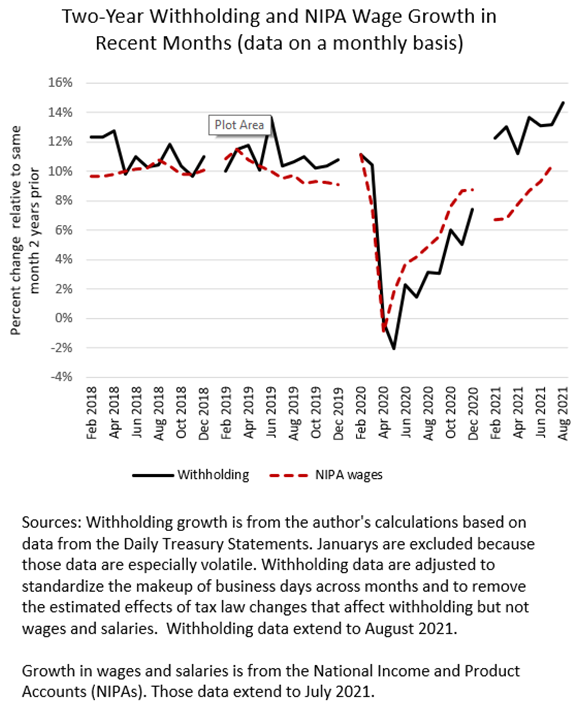

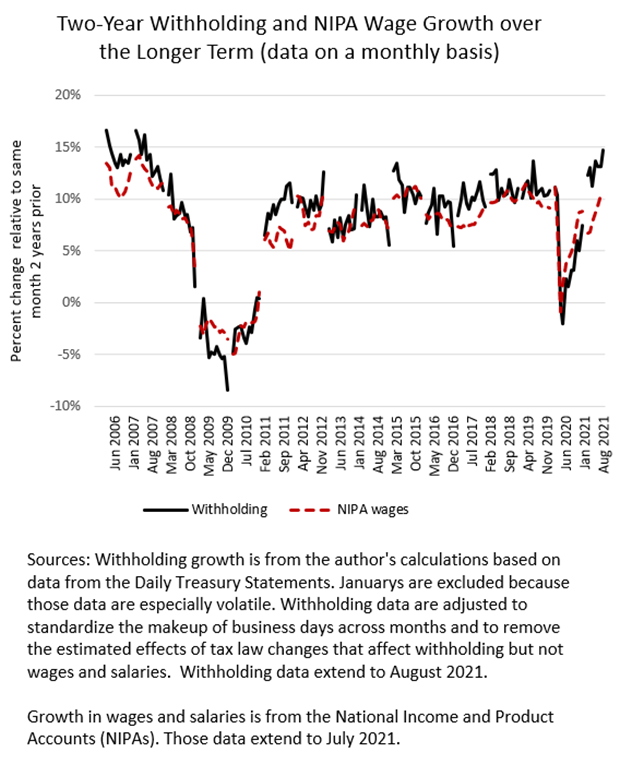

Income and payroll taxes withheld from paychecks and remitted to the Treasury Department (what we call “tax withholding” or just “withholding”) moved up in August. Compared to amounts from two years ago, we estimate that withholding was 14.7 percent higher in August, a move up from the growth of 13.1 percent recorded in both June and July (see chart below). Over a long period of time, withholding growth tends to track economywide wages and salaries, which are released with longer lags (see second chart below). Although we shouldn’t put too much emphasis on withholding for any one month, the strong August performance bodes well for the August employment report to released by the Bureau of Labor Statistics on Friday of this week. Note that withholding amounts are released daily by the Treasury Department and are very volatile depending on the day of the week and the remittance schedule that employers must follow; we standardize the withholding amounts to reflect the number and makeup of business days across months and to remove the estimated effects of tax law changes that affect withholding but not wages and salaries. And we look at two-year growth to compare to a period before the pandemic; one-year growth rates are currently very high and difficult to interpret.

Economywide wages and salaries have also been moving up in recent months. The latest data from the National Income and Product Accounts (NIPAs) show two-year growth in wages and salaries in July, the latest month available, at 10.4 percent, representing a steady increase in recent months (again, see first chart above). Withholding growth has continued to significantly outpace growth in wages and salaries. The NIPA wage data could be revised up in future months, but the discrepancy in growth rates between withholding and wages is likely to continue. The recession and recovery have seen lower-income jobs lost but, now, increases in moderate- and higher-income jobs. Because moderate- and higher-income taxpayers face higher income tax rates, that shift in wages toward higher-income taxpayers has contributed to tax withholding growing faster than wages and salaries. That phenomenon normally occurs to some extent in a growing economy, as shown in the second chart above, but the income distribution shifts since the pandemic started have increased the effect.

We’ll see if the August employment report to be released on Friday is a strong one like the tax withholding data for August.