Posted on September 29, 2020

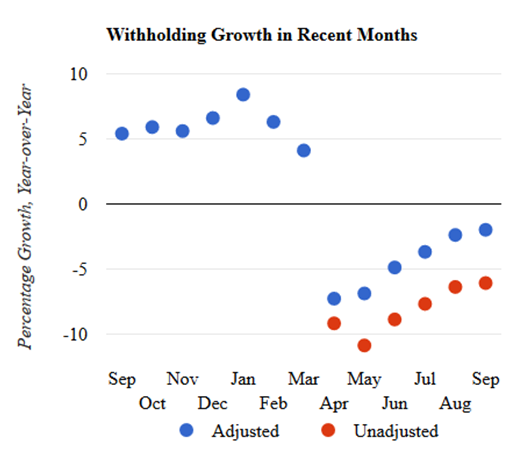

- Federal tax withholding growth by our measure continued to improve in September, but at a much slower pace than in the prior three months. For September, we estimate that economywide withholding, on a basis that removes the estimated effects of federal tax law changes enacted since March, was 2.0 percent below the amount recorded in September of last year, just slightly improved from the 2.4 percent decline in August (see the first chart below). In April, withholding fell sharply to more than 7 percent below year-ago amounts and stayed near that very depressed level in May; those declines subsequently subsided by between 1 and 2 percentage points per month until the smaller improvement in September. The same sort of improvement has occurred in withholding without any adjustment for law changes (the “unadjusted” series in the chart), but all at a lower level because the recent tax law changes have generally reduced tax withholding. Please see our methodology page for more details on how we estimate withholding growth using daily data from the Treasury Department that are highly volatile in response to the calendar.

- The improvement in withholding growth from May through August has corresponded overall with improvement in economywide, private sector wages and salaries as measured by the Bureau of Labor Statistics (BLS) in its monthly establishment survey (see second chart below). Wages and salaries are the main determinant of tax withholding. We’ll see if the BLS report for September, to be released on Friday of this week, also continues to show improvement in wages and salaries but at a slower rate. Movements in economywide wages and salaries stem from some combination of total employment, average hourly earnings, and (generally much more stable) average weekly hours worked.

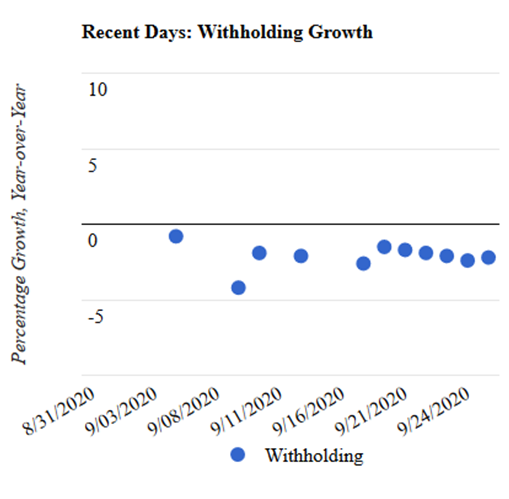

- We estimate tax withholding growth on a daily basis, with gaps for days for which calendar differences with the prior year’s same month don’t allow for reasonable comparisons–with the dates for the gaps generally known in advance. The daily measurements for withholding growth for the second half of September were clustered in a very narrow band around a 2 percent decline, which (as always) we average and thus yields the 2 percent decline for the month (see third chart below). We average those measures for the second half of the month to represent the full month because we use a lag of several weeks’ worth of tax withholding data.

\