Posted on January 28, 2022

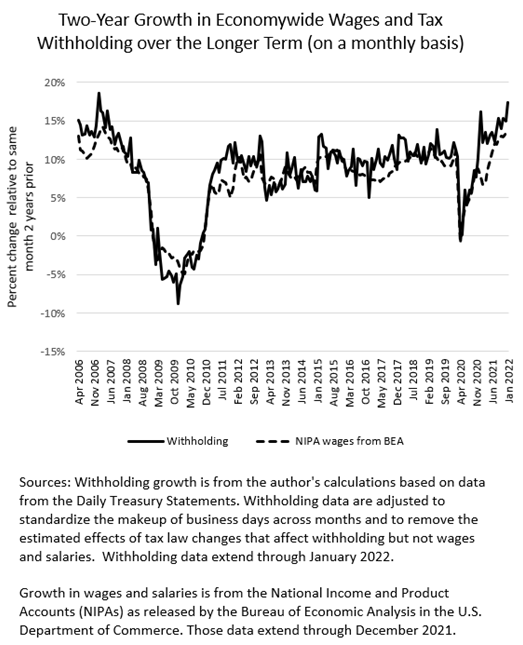

Tax withholding–the amount of income and payroll taxes withheld from paychecks and remitted daily to the U.S. Treasury–is always hard to interpret in January, being affected by year-end bonuses on Wall Street and elsewhere, but its growth has slowed this January. We measure that tax withholding was about 9.5 percent above the amounts from January 2021 (so-called year-over-year growth), after registering 11.3 percent growth in December and 13.1 percent growth in November (see chart below). Those growth figures adjust the amount of withholding to standardize the makeup of business days across months (which can affect reported monthly totals significantly) and to remove the estimated effects of tax law changes that affect withholding but not wages and salaries (currently a relatively small adjustment). Nearly 10 percent year-over-year withholding growth in January is still historically strong, although the impact on workers overall is diminished by the recent substantial increase in inflation. The decline in withholding growth in January is probably at least in part due to the omicron spread and slowing economic growth overall. Part of the slowdown as measured by year-over-year growth is expected given that the economy has opened up more and more since the spring of 2020; year-over-year growth in April 2021 was especially strong, with the amount of withholding being compared to the very depressed amounts for April of 2020, and year-over-year growth in withholding has trended down since April 2021 as each month’s amounts get compared to a progressively stronger amount in the same month of the prior year.

Economywide wages and salaries as measured by the Bureau of Economic Analysis (in the National Income and Product Accounts) and by the Bureau of Labor Statistics (BLS, in the monthly establishment survey) are available currently only through December, and both measures have been running at a lower rate of growth than tax withholding. Withholding growth typically runs faster than wage growth in a growing economy, as economic growth pushes more income into higher tax brackets, but the difference in growth rates has been larger than normal for more than a year. We attribute the relatively faster growth in tax withholding to larger growth in wages among higher-income taxpayers who face the highest tax rates and who pay a very disproportionate share of individual income taxes. We’ll see if the slowdown in withholding growth in January presages a slowdown in jobs and wage growth in the BLS monthly employment report for January to be released on Friday, February 4.

One last item: Over the past year we’ve been assessing tax withholding by looking how it compares to amounts from two years ago, to before the recession. We’ve done that in part because year-over-year growth figures are difficult to interpret when the economy goes through a recession and recovery. That two-year withholding growth in January was unusually high, at about 17 percent (see chart below, where the very last data point takes a jump up). In part that is because withholding jumped in January 2021 and didn’t revert back down in January 2022. As we said, it’s hard to come to conclusions about the economy from January withholding because the amounts tend to be much more volatile than in other months. That volatility stems both from year-end bonuses as well as from the extra holidays that make it harder for us to measure withholding growth properly using our methodology that reduces the monthly noise that results from different calendars.