Posted on January 28, 2020

Summary

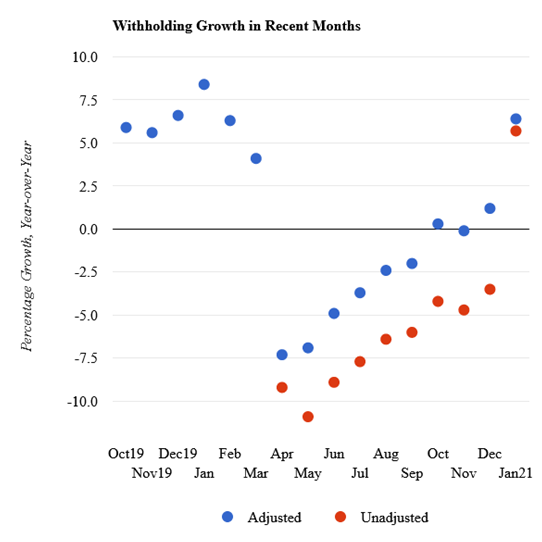

- Tax withholding remittances jumped up in January by our measure to about 6.4 percent above year-ago amounts, which would be on par with where withholding would be without the recession.

- We don’t take the withholding jump up as an indicator of how the economy is doing. Daily withholding amounts in January often swing significantly–and temporarily–as a result of year-end bonuses (which continue into the new year).

- Measurement difficulties in January also exist given the two holidays, giving us a small sample of reliable daily periods to use to gauge how withholding amounts have grown compared to those from the prior year.

- It is inconceivable that tax withholding amounts are fundamentally back to where they would be without the recession. Withholding amounts in the past week or so–a time period we consider too short to provide a reliable measure–have come back down, and we will see if that continues and withholding growth in February eventually falls back down again.

Of all the months of the year for which we measure tax withholding growth, January tends to have the weakest connection to the underlying economy. Income and payroll tax amounts withheld from workers’ paychecks and remitted daily to the Treasury Department often jump in either direction in January as a result of year-end bonuses and measurement difficulties. This January has seen an especially strong movement in withholding, jumping to about 6.4 percent above the amounts from January 2020, after being about 1 percent above year-ago levels in December (see chart below). (Those growth rates are adjusted to remove the estimated effects of law changes enacted over the past year that affect withholding but not wages; our adjustment for such law changes in January is relatively small, adding 0.7 percentage points to unadjusted growth in withholding.) Growth last January was also above its recent amounts, and it came down immediately afterward. The jump last January, though, was much smaller than this January–and if anything, one might expect growth to come back down this January when compared to last year’s unusually high amounts. In any event, it is not conceivable that tax withholding amounts are fundamentally back to where they would be without the recession.

The lack of significant legislative adjustments in January would normally give us more confidence in our withholding growth measure: it’s best to use unadjusted data–the actual data released by the Treasury Department–because the adjustments are estimated by us and thus subject to error. Our small legislative adjustment to withholding growth in January follows much bigger adjustments for most of last year. We identify only two provisions directly affecting withholding growth this January compared to last January–as we described in a previous post. First, the Consolidated Appropriations Act, 2021 extended and expanded the employee retention tax credit, which did not exist last January; we estimate the provision is reducing economywide withholding growth by about 1 percentage point. Second, the President’s executive action last August to allow employers to defer their employees’ share of Social Security payroll taxes required payback of the deferred amounts this year. The take-up of the option by employers was very small, and for those who did choose it, the payback period is spread evenly over this year. The deferred tax amounts were originally set to be recouped from workers’ paychecks and remitted to the Treasury over the January-April period, but the Consolidated Appropriations Act, 2021 extended it to the the January-December period. The payback is estimated to increase economywide withholding by just 0.2 percentage points.

But January is a special month given the year-end bonuses and the two holidays. Those holidays make it difficult for us to find representative periods of withholding both last year and this year to compare. An unlikely cause of the jump in withholding this month would be mismeasurement in the raw, unadjusted withholding data from the Treasury Department–which happens only very infrequently. We would learn about that in mid–February in the Monthly Treasury Statement for January.

We use moving averages of several weeks to gauge withholding growth, given the high amount of day-to-day variability (see methodology page). There is some evidence that withholding growth in the past week or so is back down closer to levels from before January. We’ll see if that trend continues and amounts of growth in February eventually fall back down again.