Posted May 29, 2020

Summary

- Tax withholding data for May suggest that economywide wages and salaries are moving roughly sideways compared to the amounts in April. That conclusion stems from our interpretation of both the raw withholding data and the data adjusted to remove the estimated effects of certain tax law changes.

- We are seeing evidence that our estimates of the effects of recent tax law changes are causing our adjusted measure of withholding growth to understate the declines in withholding in April and May.

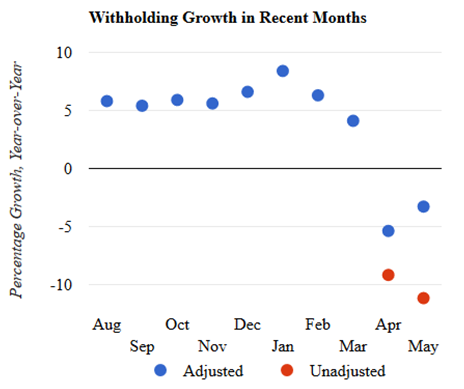

Daily tax withholding data for May suggest that economywide wages and salaries are moving roughly sideways after a terribly large drop in April. Tax withholding tends to move closely with wages and salaries in the economy, although changes in tax laws can break the link. There are two ways we measure the withholding decline in May: before and after adjustments for the effects of tax legislation enacted in March. Before adjustments–that is, using the raw tax collection data–we estimate that withholding fell by about 11 percent in May, compared to the level in May of a year ago (that is, on a year-over-year basis, which mathematically is the dollar change from May of last year to May of this year, divided by last May’s dollar amount); that decline is a bit more than the 9 percent year-over-year decline in April. We need to adjust those data, however, to remove estimated effects of recent tax law changes that affect tax withholding but not wages and salaries; in that way we can still draw a link from withholding to wages and salaries. After adjusting the withholding data to remove our estimated effect of recent tax law changes, mainly the delay allowed to employers in remitting their share of Social Security payroll taxes, we estimate that withholding declined by about 3 percent year-over-year in May, compared to about a 5 percent decline in April (see chart below). (The difference between the adjusted and unadjusted measures was greater in May than in April because we expect that firms only gradually responded to the law changes in April.)

We are, however, seeing evidence that our adjustment for recent law changes is overstating the effect, and thus we would be understating the decline in withholding on an adjusted basis. (It doesn’t affect the unadjusted measure.) That evidence doesn’t change our conclusion that wages and salaries are roughly moving sideways in May compared to the amount in April, but it does affect the adjusted estimates for both April and May. We are re-examining the estimates of the law changes and plan to have updated estimates before we start getting the next round of withholding measurements in the first part of June. The updated estimates should show that withholding growth, on an adjusted basis, declined in both April and May by more than we currently estimate, but in both cases still less than the decline in the unadjusted data.

Regarding the effects of recent tax legislation, early information from financial statement filings suggests that firms are not taking nearly as much advantage of the allowed partial withholding remittance delay as initially expected. The CARES Act, enacted in late March, allowed all firms this year to delay remitting their share of Social Security payroll taxes for an extended period, until the end of 2021 or 2022. (Those payroll taxes are about 17 percent of total withholding.) We have looked for recent quarterly financial statements of the largest 500 public firms that cover a three-month period ending in late April or in May (so including a month or so after the law change), and so far have found 10–a small number because these are firms with unusual quarterly reporting periods–and only one of the firms appears to have taken advantage of the remittance delay. Smaller firms may have different behavior, and the sample of large firms is currently very small.

That early observation from financial statements on usage of the remittance delay is markedly different than the official Congressional estimates of the Joint Committee on Taxation, released at the time the legislation was under consideration by the Congress, which appeared to me to incorporate the expectation of near universal use of the remittance delay. However, when making our adjustment for the effects of legislation, we have been reducing the Joint Committee on Taxation’s estimate of that provision by roughly half, as posted last month, to take into account various considerations, such as the timing of the associated income tax deduction and concerns that management would be personally liable for any taxes unable to be remitted down the road; those considerations may have convinced firms that they were better off not delaying their payroll tax remittances even though the delay acts like an interest free loan. Firms also may be focusing their energies elsewhere than in reconfiguring their payroll tax remittances. In any event, it is looking like we need to reduce the effect by perhaps much more than we have been.

Policymakers have also recently enacted certain payroll tax credits, and they also could have significant effects on withholding. Their effect on tax withholding also looks to be less than originally expected by the Joint Committee on Taxation. Those original estimates were clearly subject to substantial uncertainty given the unknowable progression of COVID-19 and the responses of firms to utilize the credits. Information of the effects of the credits will be difficult to obtain until employers file their quarterly employment tax forms (form 941), which are due at the end of July for the April-June quarter. Financial statements may, though, provide some indication of utilization of the payroll tax credits.

We’re currently in a period of a week and a half in which we don’t get any reliable daily withholding measurements. The very end and beginning of a month have volatile withholding payments that are very difficult to filter reliably, so we don’t provide any estimates of withholding growth for those days. And we lose additional data because of the effects of the Memorial Day holiday (see our methodology). The next withholding measurement we get is for Friday, June 5, for which we get the data from the Treasury Department on Monday, June 8.