Posted on January 3, 2022

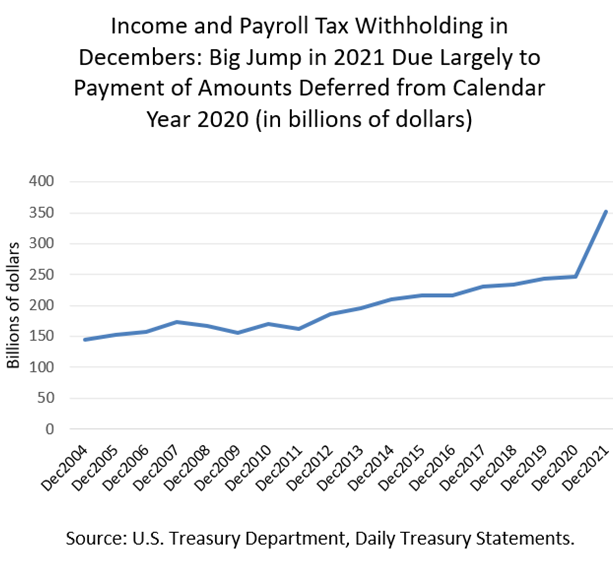

Happy New Year, everyone. Today we received the Daily Treasury Statement for the last day of December, identifying the final amount of tax payments for calendar year 2021. Amounts of income and payroll taxes withheld from paychecks and remitted to the Treasury–what we refer to as tax withholding–jumped sharply in December, from about $250 billion in December 2020 to about $350 billion in December 2021 (see chart below). The biggest factor in that increase probably reflects the payment of payroll taxes deferred from April through December 2020, which we estimate boosted overall withholding payments in December 2021 by about $55 billion (see more about that below). The rest of the overall $100 billion increase probably reflects a combination of factors, most significantly growth in wages over the past year–as withholding without the effect of law changes has been growing by 10 percent or more above prior-year amounts even before December, and on top of that we expect that year-end bonuses were strong this December. Thus, wage increases explain, we estimate, about $30 billion of the overall withholding increase (10 percent of December 2020’s $250 billion for normal pre-December growth, or $25 billion, plus $5 billion or so for growth in year-end bonuses). Also contributing to the jump, we believe, was the calendar, as the composition of business days in December 2021 was slightly more weighted to the bigger withholding days that follow paydays; that was perhaps worth about $5 billion to $10 billion in additional withholding in December 2021 compared to December 2020. In addition, withholding in December 2020 was held down by maybe $7 billion or so from deferred payroll taxes, thus boosting growth in December 2021 by that amount.

The repayment of the deferred payroll taxes in December 2021 was not a surprise. The CARES Act, enacted by policymakers in late March 2020, allowed employers to defer paying, through the last 9 months of 2020, the employer part of the Social Security payroll tax–which is assessed at 6.2 percent of wages up to the taxable maximum amount of wages of $137,700 per worker for that year. (The employee pays the other half of the Social Security tax.) Shortly after enactment we didn’t think many employers were taking the federal government up on the option, but it turned out that a substantial number of larger employers did–to the tune of about $126 billion in deferred payments in 2020 according to estimates from a Treasury Department economist, Lucas Goodman, who had access to confidential tax data and has a working paper that well documents the findings. That deferral amounts to about 27 percent of total employer-side Social Security tax withholding for the period, not a small percentage.

Of the estimated $126 billion in deferred payroll taxes, by law one-half had to be repaid by December 31, 2021, and the other half by December 31, 2022. Total withholding payments in December 2021 look to be roughly consistent with the payment of half of the estimated total $126 billion in deferred amounts (so $63 billion), with a slight reduction of maybe $4 billion paid in mid-September, which, thanks to technical accounting and tax rules, could still be claimed as a deductible business expense for 2020 by some firms. And a few billion was probably paid back in other months, but was too small to stick out in the overall amounts reported. So, we estimate that about $55 billion was paid in December 2021. The withholding amounts started jumping in mid-December, and remained above what we would have expected without the deferral repayment through the end of the month. Again, amounts could certainly have been paid at any time in 2021, but the biggest jumps in the overall withholding data that we observed were in mid-September and then especially in December.

Then we presumably see the same thing again next December with the payment of the other half of the deferred amounts. Interest-free loans from the federal government aren’t a bad deal, even with interest rates so low.