Posted on October 6, 2021

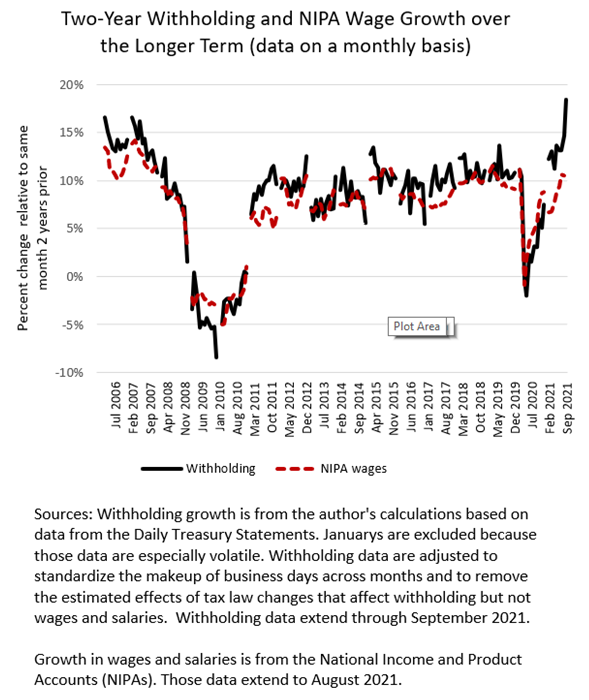

Income and payroll taxes withheld from paychecks (so-called tax withholding), which is based largely on wages paid to workers and is remitted daily to the Treasury Department, popped up in September, probably enough to be considered an outlier, but these days who knows. We measure that tax withholding was up 18.4 percent compared to the amounts collected in the same month two years ago, in September 2019. That’s a significant move up from the 14.7 percent two-year increase recorded in August (see chart below). Those measures all remove the estimated effects of tax law changes affecting withholding (which we estimate is small over the recent two-year period) and standardize the withholding amounts to reflect the number and make-up of business days across months. Our methodology (see our description) attempts to remove the effects of holidays shifting around within a month, but it is possible that Labor Day occurring at the very beginning of September 2019 and after three business days had elapsed in September 2021 may be distorting our measurement. If that’s the case, then we should see a withholding dip this month. But it is also possible that the recent tax withholding data, at least in part, are signaling that labor market pressures are increasingly boosting wages. Why do we look back two years instead of just to last year? Because one-year growth rates are currently very high, being compared to depressed levels from a year ago, making them difficult to interpret, and also because the one-year growth rates are more susceptible to error measuring the legislative effects, which were especially large last year.

Over a long period of time, withholding tends to track overall wages and salaries in the economy (see chart below), and the withholding data are available more quickly than are the more direct measures of wages and salaries. Again, the withholding move up in September looks like an outlier, but we won’t know until more daily withholding data and monthly wage and salary data are available. Currently, we have wage and salary data available from the National Income and Product Accounts (NIPAs) only through August. The Bureau of Labor Statistics (BLS) releases the employment report for September on Friday of this week, and we’ll see if it shows strong employment and wage growth for September. Those BLS data will be incorporated into the next NIPA release, scheduled for late this month and which will cover the economy through September; however, the NIPA wage data are subject to much revision when more comprehensive data are available several months later from tax returns remitted by businesses to states for purposes of administering the unemployment insurance system.

Even ignoring the data on withholding for September because they might well be outliers caused by measurement error, withholding growth in recent months has been well outpacing wage and salary growth in the NIPAs. The difference is even greater when looking at wage and salary data from the BLS monthly reports (not shown). We attribute the recent, significant excess growth in withholding over wages as an indicator that higher-income taxpayers, who face higher income tax rates, have been faring much better through the recession and recovery than have moderate- and lower-income taxpayers. Over a long period of time in a growing economy, withholding tends to rise a bit faster than wages and salaries because growth in inflation-adjusted incomes tends to push more income into higher tax brackets (the phenomenon called real bracket creep); but the recent excess of withholding growth over economywide wage and salary growth has been much more than can be explained by that phenomenon.