Posted on August 2, 2021

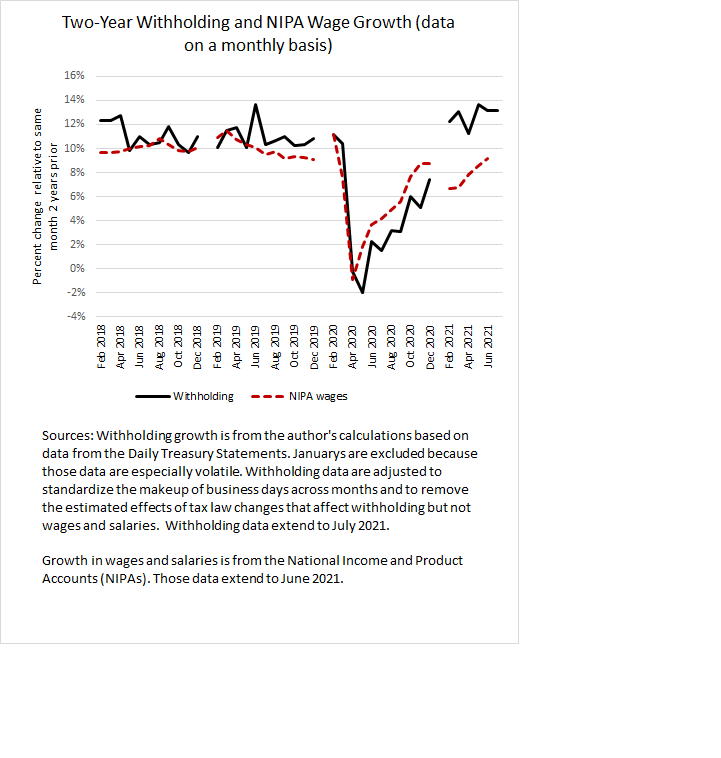

The amount of federal tax withholding–income and payroll taxes withheld from paychecks and remitted to the Treasury–remained strong in July. Based on daily data released by the Treasury Department, we estimate that tax withholding in July grew by 13.1 percent above amounts from two years ago in July 2019, the same two-year increase we measured for June (see chart below). Since February, we have measured that such growth has been in a relatively narrow band between 11.2 percent (April) and 13.7 percent (May). Two-year growth for recent months has been at or above that recorded before the pandemic. We look at two-year growth in order to compare to a period before the recession; one-year growth rates compare to the depressed levels of a year ago and are currently quite high and hard to interpret. The continuing strong tax withholding bodes well for the employment report for July that the Bureau of Labor Statistics will release on Friday of this week.

Note that we adjust withholding amounts to standardize them for the number and makeup of business days across months, and to remove the estimated effects of tax law changes that affect withholding but not wages and salaries; the law change adjustment for two-year growth is currently small at less than one percent. Without the business day and law change adjustments, the daily withholding data are very volatile and difficult to interpret (see our methodology).

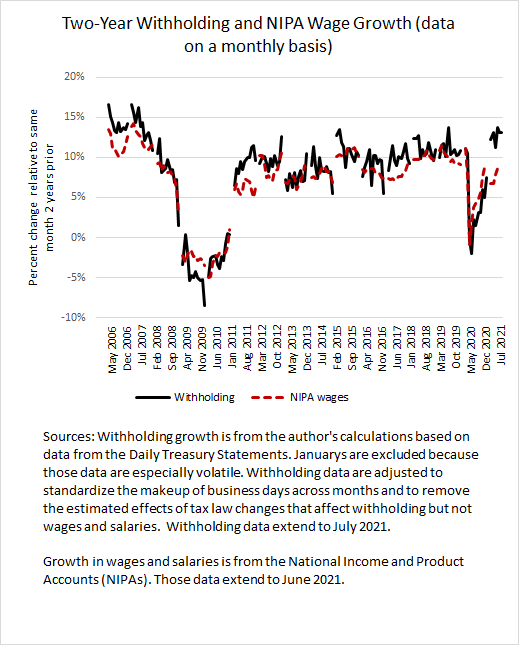

Withholding growth over a long period of time has correlated well with growth in economywide wages and salaries. Since the beginning of this year, however, withholding as we measure it has been growing much faster than have economywide wages and salaries as measured in the National Income and Product Accounts (NIPAs) that are compiled by the Bureau of Economic Analysis (see chart below, which uses the same data as the chart above but focuses on just the past few years). The NIPA measure of wages was just revised for 2020 in late July (see post from last week). Eventually, the Bureau of Economic Analysis will revise the NIPA wage and salary amounts for 2021; the first quarter amount will first be revised in the NIPA release late this month to incorporate data from the Quarterly Census of Employment and Wages (which are partially released in mid-August and then completely so in early September). We’ll see if the first quarter NIPA wage and salary data are revised up either late this month or in future months. The withholding tax data would say yes, but with a caveat. Higher-income taxpayers have done better financially in the recession and recovery than have other individuals, and higher-income taxpayers face higher income tax rates and pay a disproportionate share of the income tax. As a result, some of the gap between growth in withholding and wages and salaries may represent an increase in the average tax rate on wages. Indeed, over long periods of time, withholding growth in an expanding economy tends to slightly outpace wage growth because of the phenomenon called real bracket creep, in which increases in real (inflation-adjusted) wages that are equally distributed across the income distribution tend to push more income into higher tax brackets; when income growth becomes more skewed toward higher-income individuals, the effect becomes stronger.