Posted on April 24, 2022

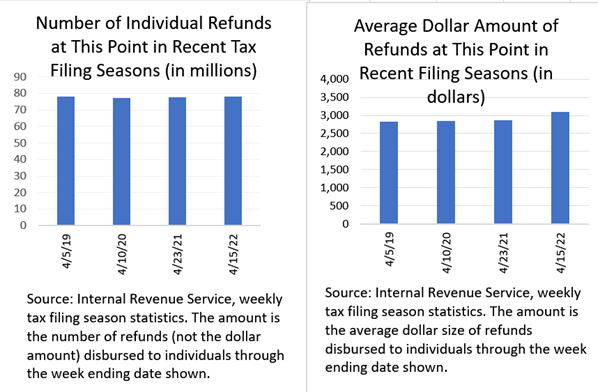

It’s a busy season for tracking tax receipts, and we turn our focus back to individual income tax refunds. With almost 80 million refunds sent out to taxpayers so far this filing season (through April 15 in the IRS’s latest weekly report released last Friday), the average size of a filer’s tax refund ($3,103) is about 8 percent to 9 percent above the amount at the comparable point in the past 3 years when about the same number of refunds had been disbursed (see chart below). This is our third post on tax refunds this filing season, and in the first post, about a month ago, the average refund was up between 9 and 13 percent compared to the amounts in the past three filing seasons. The drop-off in the percentage increase has occurred as the later filers, who tend to have higher income, have filed their returns. For the last 20 million of those nearly 80 million refunds sent to taxpayers so far this year, the average refund has been down by about 5 percent compared to last year’s average refund for the 20 million or so disbursed in the same order (that is, roughly between the 60 millionth and 80 millionth refund disbursed). With another 20 million or more refunds still to be disbursed over the next month or so for timely-filed returns, if that average refund drop-off continues, then the average refund this year could drop to being about 5 percent to 6 percent above last year’s amount, not a particularly large increase. The fiscal boost to the economy from refunds earlier in the filing season appears to be waning. After those refunds from timely-filed returns are disbursed generally by the end of May, then there are probably another 15 million to 20 million refunds for late filers or those who filed for a 6-month extension, which get paid out mainly over the June to October period.

Tax law changes enacted last year that helped lower-income taxpayers are probably causing much of the more rapid than usual drop-off in the size of the average refund as the filing season progresses. The average refund almost always drops late in the refund season with the filing of returns by high-earners, for whom getting a tax refund early in the filing season is not critical for their day-to-day finances, and whose refunds are generally smaller. The bigger drop-off than usual in recent weeks is consistent with three tax provisions affecting tax year 2021 that boosted, for people with income up to certain limits, the child tax credit, the earned income tax credit, and the tax credit for child care expenses. Those generally lower-income recipients tend to file for refunds earlier, given that many need the funds as quickly as possible, and the boost in the credit amounts pushed up the value of their refunds. The bigger drop-off than usual in the average refund size is also consistent with what is looking like a boom year in final payments with tax returns, which are overwhelmingly paid by higher-income taxpayers (see post of April 21). Not only are those higher-income taxpayers generally paying more in final payments than in recent years, but those with refunds are probably often getting smaller ones as well. We’ll see if the drop-off in the average refund size continues over the next month.