Posted on March 20, 2022

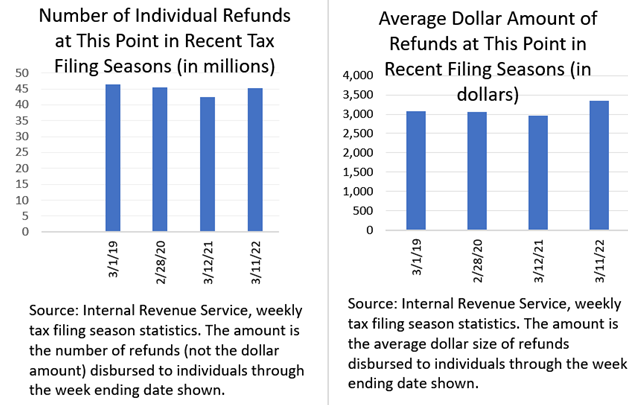

The Internal Revenue Service (IRS) has disbursed about 45 million refunds to individuals so far this tax filing season (through the week ending March 11), and the average size of those refunds, about $3,350, is up between 9 percent and 13 percent compared to roughly the same point in the past three filing seasons (see chart below). That bump up in refund size suggests that they are giving an extra fiscal boost to the economy compared to previous years. At least part of the cause could be legislative changes enacted last year, most significantly three provisions affecting tax year 2021 alone: higher amounts of the child tax credit; higher amounts of earned income tax credits for childless individuals; and higher tax credits for child care expenses. Given that those three credits were boosted for just one year, and are falling back down again this tax year (for the corresponding filing season occurring next year), the fiscal boost from refunds could be much less next year–unless federal policymakers again change the law. A caveat for our analysis is that the average amount of refunds varies through the filing season, and it’s difficult for us to identify the comparable period of past years to compare this year’s refund amounts to: we are looking at the point in each filing season when the first 45 million or so taxpayers received refunds, which occurred this year (as reported in the most recent IRS release) at about the same point as last year (even though last year’s filing deadline was later), but occurred about a week or two later this year compared to both the 2020 filing season (still before the pandemic hit in full force) and the 2019 filing season. In the past several years, there have eventually been about 110 million to 130 million refunds disbursed, so we’re probably only about 35 percent to 40 percent of the way through the disbursement of all refunds.

It is quite possible that we are at least in part seeing the refund-boosting effects of the higher child tax credit, earned income tax credit, and tax credit for child care, that were enacted in the American Rescue Plan Act in March 2021. Let’s start with the child tax credit. It was significantly increased for one year, tax year 2021, from the previous amount of $2,000 per child under age 17 (with age measured at the end of the tax year) to $3,600 per child under the age of 6 and $3,000 per child from the ages of 6 through 17 (adding an extra year to the age limit for children qualifying). There were also other changes to the child tax credit for the same one year such as it being provided to people regardless of whether they had earned income. As before, there are income limits to receiving the credit. (Those overall changes to the child tax credit, including an advanced payment mechanism to be discussed below, were important in cutting the child poverty rate in 2021, according to reputable estimates, but that is another story.)

Knowing whether those higher child tax credits are adding to tax refunds is made difficult by a provision of the law that provided families (unless they opted out) with monthly advanced payments of the credit for half of the year. Those payments started in July 2021 at the rate of $250 to $300 per child (depending on the child’s age and based on information from previous tax returns). So, if a family with one qualifying child age 11 got 6 such payments in 2021 (from July through December) of $250 each, that would be $1,500 of the credit paid in advance, leaving $1,500 of the $3,000 total credit to be received upon filing a tax return for the year. That $1,500 amount claimed when filing a tax return would be less than the full $2,000 taken at tax time last year, so that factor could actually reduce the amount of refunds this year. But for people who opted out of the advance payment of the credit, or didn’t get the advance payments for various reasons (for example, anyone have a new child last year?), their credit at tax filing would be up from $2,000 in last year’s filing season (for tax year 2020) to $3,000 or $3,600 this year (for tax year 2021), increasing refunds. The Congressional Joint Committee on Taxation (the staff of which estimates the federal budgetary effects of tax law changes under consideration by the Congress) estimated last year that the enhancements to the child tax credit would increase federal spending and reduce revenues by about $105 billion over fiscal years 2021 and 2022, but the amount of that in the form of advanced payments is not available. According to the Treasury Department, about $93 billion in advanced payments were made from July to December. But some of the higher credit reduces the amount of tax payments for people who owe when filing their tax returns, or contributed to a reduction in quarterly estimated payments, so it’s hard to tell whether there are still lots of extra refunds to be claimed during this tax filing season from the higher child tax credit.

The changes to the earned income tax credit and the tax credit for child care expenses are unambiguously increasing refunds, and the effects aren’t small. The earned income tax credit (EITC) was increased most significantly for those taxpayers without children, with the maximum credit almost tripled. JCT estimates that, along with other changes to the childless earned income tax credit, the enhancements will increase federal spending and reduce revenues overall this fiscal year by about $12 billion. Perhaps three-quarters of that, or $9 billion, comes from higher refunds. When scaled to the total amount of refunds disbursed of between $320 billion and $365 billion per year over the past four years, that expected extra amount of refunds from the legislative change to the EITC would amount to about 3 percent.

In addition, again for one year alone, the amount of child care expenses that qualify for the credit increased from $3,000 to $8,000 per child (for up to two children), and at a higher credit rate–so the maximum credit amount increased from $1,050 per child to $4,000 per child. And critically, the credit for 2021 is refundable–that is, people can get the credit in the form of a refund when they file their tax return even if they have no income tax liability. That’s a big change for individuals with child care expenses, especially for lower-income taxpayers, and JCT estimated that the changes overall will increase federal spending and reduce revenues by about $6 billion this fiscal year, thus less than the effect from changes to the earned income credit.

So, we’ll be watching refunds as the tax season progresses to see if the average refund amount continues to run higher than in previous years.