Posted on July 26, 2020

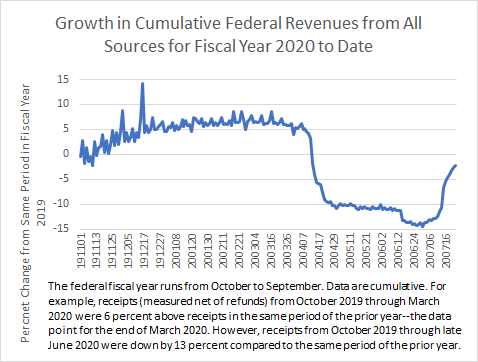

Here’s a one-paragraph post for a change. The IRS is still counting the money from checks that taxpayers remitted with their 2019 tax returns, which were due by July 15. This upcoming week should see the end of that counting. By my calculation, total revenues from all sources for the current fiscal year to date (thus from October 2019 through Thursday of this past week) are about 2 percent below the amounts from the same period of the prior fiscal year (see chart below). That is a big rebound from receipts in the current fiscal year being down by about 13 percent through June. The rebound stems primarily not from real economic factors, but rather from the end of payment delays provided to individuals and corporations that expired in mid-July. We’ll see how much more rebound occurs this week, the final week of July, with Tuesday’s receipts (released on Wednesday) possibly being the end of the counting of amounts paid with tax returns. Typically not enough would remain uncounted at this point to quite get total revenues this fiscal year through July back to unchanged relative to those in the same period of fiscal year 2019. And even if revenues for the fiscal year through July were to be unchanged relative to year-ago amounts, revenues since April have been below year-ago amounts and will presumably continue so in coming months.