August 3, 2020

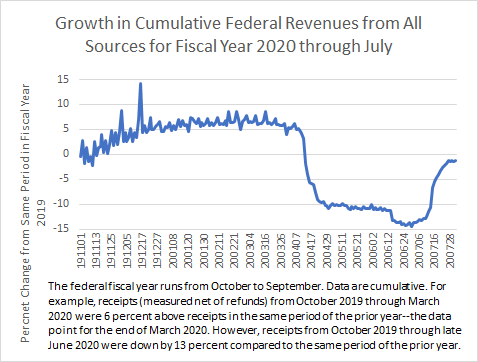

Federal tax receipts for July are now in the books, and the IRS has completed counting all the money deposited with tax returns filed by this year’s extended July 15 deadline. I calculate that total receipts from all sources for this fiscal year to date, thus from October 2019 through July 2020, are down by about 1 percent from last fiscal year’s amounts (see chart below). They had been down by about 13 percent through June, but large, catch-up payments in July came close to getting receipts back to unchanged from last year’s amounts. As we’ve been discussing, the delay until July of individual and corporate income tax payments normally due in April and June boosted July’s receipts tremendously. Nonetheless, receipts have still been weakened substantially by the economic downturn.

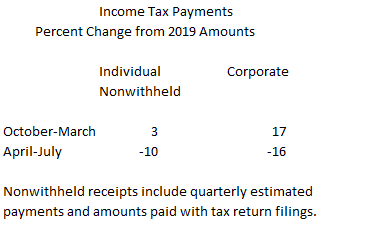

We estimate that both nonwithheld individual income tax payments (consisting of both final payments with tax returns and quarterly estimated payments) and corporate income tax payments fell over the April-July period from year-ago amounts, after registering gains from October to March (see table below). (Looking at receipts from April through July both removes most effects of the payment delays and captures the main period since the economic downturn began.) Withheld income and payroll tax payments have also fallen in recent months below year-ago amounts, after rising in the October-March period. One issue that wouldn’t affect total receipts but would affect the composition is that we’ve been wondering if, maybe even expecting that receipts in the Daily Treasury Statements in mid-July showed too much withholding and too little of something else, perhaps corporate income taxes or even individual nonwithheld payments. (See previous post.) If that reallocation of receipts is made by the Treasury Department in its monthly tabulation released next week, then that would reduce the April-July revenue reductions we currently calculate for either or both of corporate and individual nonwithheld receipts.

Clearly the sharp economic downturn has hit tax receipts in recent months, and will presumably continue to do so in coming months. (Some of the decline in individual nonwithheld receipts probably reflects economic activity in 2019, though, as discussed in a previous post.) It is hard to see how total receipts could end the fiscal year anything but down compared to those in fiscal year 2019. In addition to the declines in receipts in recent months that should continue at least into the near future, some elements of the CARES Act, enacted in March, should have downward effects on receipts that haven’t occurred yet–but should soon. In particular, businesses were allowed an enhanced ability to use losses to obtain refunds of past taxes paid, and the large bulk of those expected, significant effects on tax revenues have not yet occurred. And additional legislation currently being considered by the Congress to bolster the economy could very well bring about additional reductions in revenues in coming months.