Posted on April 2, 2025

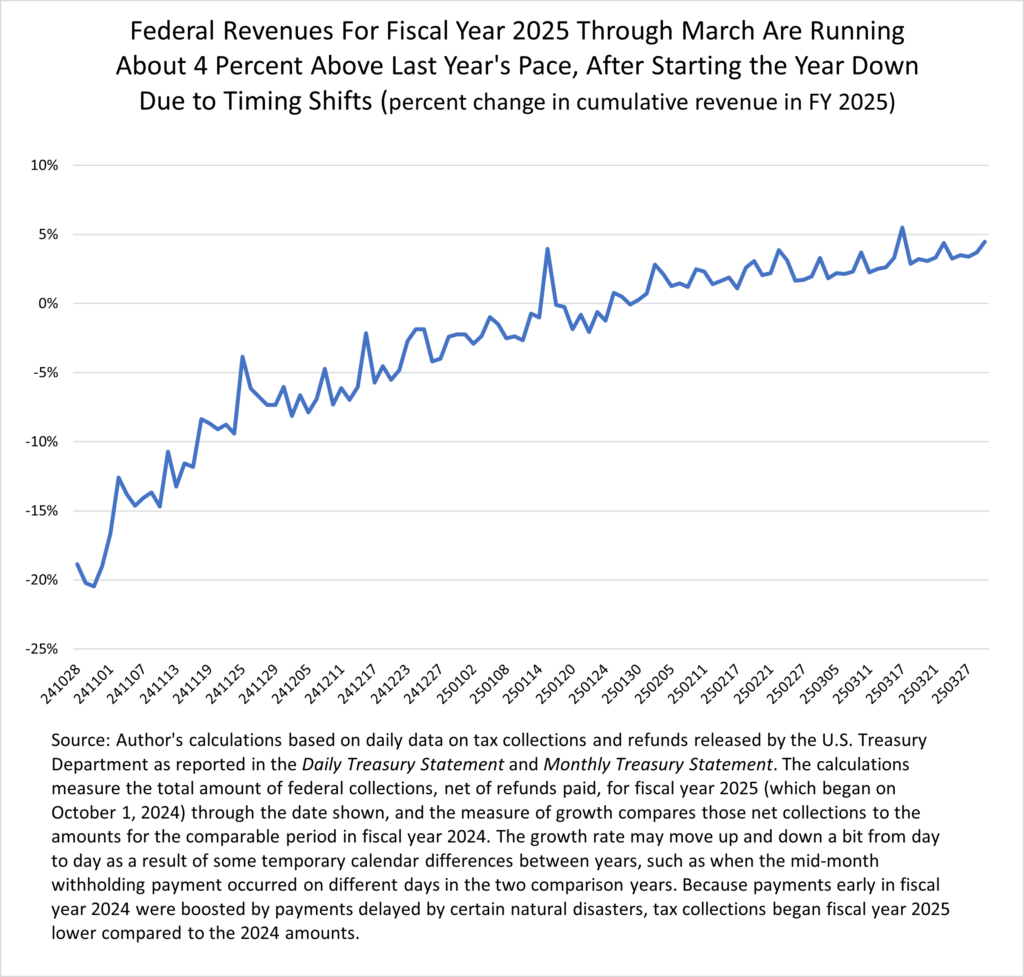

We have reached the halfway point in the 2025 federal fiscal year, and we are coming up closer to the April 15 income tax filing deadline. Through the end of March, we estimate that total federal revenues were about 4 percent higher than through the same point in fiscal year 2024 (see chart below). On the taxtracking.com homepage, we are tracking total revenues on a daily basis for the rest of the fiscal year–using data released daily by the U.S. Treasury Department in its Daily Treasury Statement.

I am expecting that total revenue growth for the full fiscal year will be higher than the 4 percent for the year-to-date. In its latest projection of revenues back in January, the Congressional Budget Office estimated that total federal revenues would increase by about 5 percent in fiscal year 2025, barring legislative or other administrative actions (such as tariff increases) in the rest of the fiscal year. I expect that total revenue growth for the year will exceed that estimate of 5 percent growth, even without tariff increases. In particular, I am expecting that payments this month with individual income tax returns for tax year 2024 will be significantly higher than last year’s, as a result of the continued economic growth in 2024 and the continued boom in the stock market that year. Stock market boom years tend to correspond with relatively large increases in capital gains and other related incomes, such as taxable withdrawals from retirement accounts, and those boost payments with tax returns. In addition, I believe we already saw evidence from tax withholding of an increase in Wall Street year-end bonuses and related incomes–which also tend to correspond with large increases in payments with tax returns in the subsequent April. One factor going in the opposite direction is filing delays granted to taxpayers in California affected by the recent wildfires, but I don’t believe that will offset the factors suggesting strong April payments.

There have been reports in the press from sources at the Treasury Department that large staffing cuts at the Internal Revenue Service (IRS) will cause large reductions in revenues this April, with a 10 percent reduction cited. Although tax refunds and payments may be processed more slowly this tax season than usual, I believe that the effects of those IRS spending cuts on revenues will largely be down the road, rather than immediate. The consensus is clear that additional spending on IRS enforcement eventually–measured in years–yields additional revenue that is several times the amount spent. Thus, additional money spent on IRS enforcement eventually more than pays for itself–although the additional revenue yield would get smaller as more and more is spent. Likewise, cuts in the IRS enforcement budget would eventually cause much larger reductions in revenues.

My bigger concern for the federal budget outlook from large cuts in IRS enforcement is from the loss of voluntary tax compliance, which is more of a longer- than short-term issue. Higher-income individuals, often with more complicated tax returns that include business income and who have less information reporting to the IRS about their income sources, along with corporations, have the greatest opportunity for taking aggressive tax stances or outright evading their tax responsibilities. IRS enforcement activities are able to catch a chunk of that, and it often takes years to fully resolve the cases. Some of that activity would clearly go away with large cuts to IRS funding. If large cuts to IRS enforcement activity persist, then people could begin to view the tax collector as being toothless and very unlikely to catch them. That can happen if resources spent on tax enforcement get small enough for long enough, and then more and more people start to evade taxes. The loss of voluntary tax compliance can start a downward revenue spiral.

In any event, we will be tracking revenues through the second half of the fiscal year. The revenue amounts will have immediate implications for the U.S. Treasury Department and its borrowing hitting up against the federal debt limit. That is most likely to occur sometime in August or September according to the Congressional Budget Office estimates, assuming no legislative action to raise the limit before then. Faster-than-expected revenue growth could delay that somewhat, and the opposite if revenues fall short of expectations.