Posted on July 1, 2022

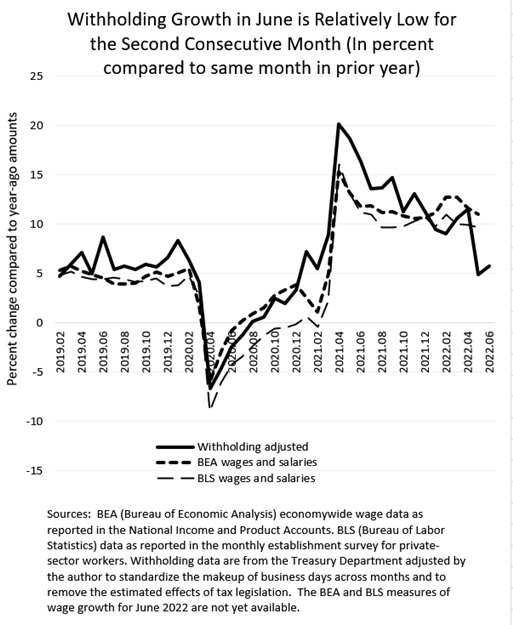

We’ve now had two consecutive months with much slower growth in the amount of federal income and payroll taxes withheld from workers’ paychecks and remitted to the U.S. Treasury Department. Those amounts–what we call tax withholding–grew by an estimated 5.8 percent in June above the amounts from June of a year ago, a move up from the 4.9 percent growth in May (compared to the amounts in May of 2021), but still much lower than in the first four months of the year when withholding grew in the 9 percent to 12 percent range (see chart below). The amount of tax withholding tends to move with overall wages and salaries in the economy, and the tax payment data become available more quickly than direct measures of economywide wages and salaries. We construct the measure of tax withholding from daily reports released by the U.S. Treasury, but adjusted by us to remove the estimated effects of tax law changes (currently a relatively small adjustment) and to standardize the makeup of business days across months (see our methodology). Observing two consecutive months of slowing withholding growth gives us confidence that we are not observing a data anomaly.

Other, more direct measures of wages and salaries in the economy–from the Bureau of Economic Analysis (BEA) in its GDP accounts and from the Bureau of Labor Statistics (BLS) in its monthly establishment survey–do not yet show a slowing in growth at all like the withholding data do (again, see the chart below). Those direct wage measures are currently available only through May and are subject to revision. The BLS establishment report for June will be released on Friday of next week, and we’ll see if those data show wage growth slowing significantly. A slowdown could be reflected either in slowing growth in jobs or in average hourly earnings, or both. Growth in average hours worked per week could also be slowing, but that tends to vary much less than do jobs and average hourly pay.