Posted on December 24, 2020

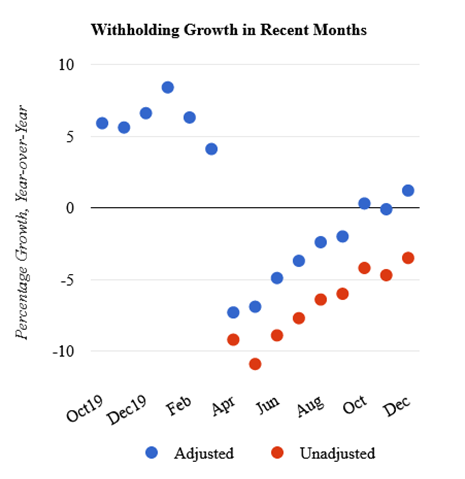

By our measure, income and payroll taxes withheld from workers’ paychecks, which tend to move with economywide wages and salaries, have improved in December. We estimate that tax withholding was 1.2 percent above the amounts from December of a year ago, measured to remove the estimated effects of federal tax law changes enacted since March and to standardize the number and makeup of business days across months (see chart below). Withholding growth has now improved in each month since April with the exception of a slight dip in November. Withholding amounts in October and November were both very close to year-ago amounts. The improvement since April has also occurred in withholding unadjusted for law changes. (The law changes, mainly from the CARES Act enacted in March, have reduced withholding.)

We’ll see if that improvement in tax withholding portends a strong, or at least stronger-than-expected employment report for December to be released by the Bureau of Labor Statistics on Friday, January 8. The improvement in withholding in December has occurred despite the reimposition of some pandemic-related restrictions on activity and mixed reports from weekly unemployment insurance claims. Interpreting withholding for December and January is always tough because of year-end bonuses. Those bonuses disproportionately go to higher-income workers who face higher income tax rates, which means that withholding can move without corresponding movements in employment. Overall Wall Street bonuses, however, are expected to be weaker this year than last, so that would not be consistent with our observed improvement in withholding.

The holidays also make it harder to interpret withholding in December and January. We do, though, already have our measure of withholding for December, even without the withholding data for the period between Christmas and New Year’s. We do not obtain reliable measures of withholding growth when incorporating withholding data near holidays and at the very end and beginning of months (see our methodology).