Posted on March 24, 2020

We’re getting data on growth in tax amounts withheld from employees’ paychecks in the second half of March that confirms what we saw in the first half of the month: withholding growth has dropped off significantly this month. That is a clear recession indicator, and it may just be the beginning of a much more significant decline in coming weeks given the economic disruptions from the responses to the coronavirus. It may even be consistent with what many analysts are expecting as a terribly large increase in initial unemployment claims in this Thursday’s release of data.

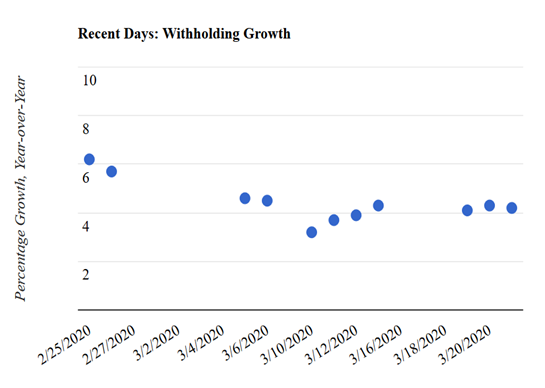

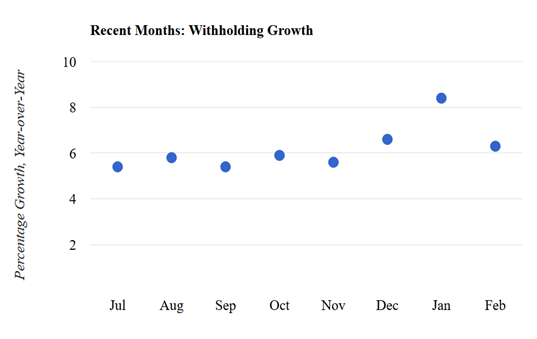

The drop-off in withholding growth of about 2 percentage points so far in March—from a little over 6 percent in February to just over 4 percent so far in March (all comparing amounts of withholding this year to amounts a year ago)—is very significant but has to be put in some context (see first chart below for growth of withholding in recent days). Withholding is what we call a noisy series, often bouncing around in the very short term for reasons that seem unrelated to economic conditions. What makes the recent drop so significant is that it follows a period in which our measure of withholding growth has been very stable, namely growing between 5.5 percent and 6 percent in each month from July through November last year, before rising temporarily in December and January during bonus season, but falling back again in February (see second chart below). Movements during the bonus season can often cause temporary movements that do not indicate underlying economic activity.

The drop-off in withholding growth of that magnitude so far in March usually, but certainly not always, indicates a recession. Since 2006, the economy has been in recession in 9 of the 15 months in which the withholding growth measure has dropped by more than 1.5 percentage points relative to its average of the previous four non-December/January months. We are currently showing about a 1.6 percentage point drop-off in March relative to the average of the previous 4 months (again, dropping the measures for November and December). It is no surprise that the economy would be moving quickly into recession given the economic disruptions from the coronavirus.

Could the drop in withholding growth be consistent with what some economists predict for Thursday’s initial unemployment insurance claims report (for activity last week): that it will show claims climbing from about 280,000 to roughly 1.5 million in just one week, when even in the depths of the 2007-2009 recession we never had more than a 50,000 person increase in any one week and the largest total for any one week was less than 700,000? Well, in theory yes, but in the past the withholding data haven’t been tightly linked on a week-to-week basis to the initial claims data. Without going through the math, when a year-over-year measure of growth drops some, it implies a much larger drop in the amount relative to the prior month—unless the measure of growth exactly 12 months prior was unusually high. Well, there was nothing very unusual about withholding growth and the economy last March, but unfortunately there is this March.

If year-over-year withholding growth is down in March by, say, 1.6 percentage points relative to February’s growth (using the averaging technique above rather than the change relative to February), that would be consistent with roughly a one percent drop from February to March in withholding (not withholding growth, but the dollar amount of withholding itself, and not at annualized rates, either; math not shown). That’s huge, because if it all came from employment (rather than from hours worked or average wages, or was just statistical noise), a one percent drop in employment is between one and two million jobs. That would imply a terrible increase in initial unemployment insurance claims very soon. Many people don’t qualify for unemployment benefits or don’t or can’t claim them quickly, so it’s very hard to estimate how high the initial claims in this week’s report will be. It is clear that none of the past drops in withholding growth of the magnitude we are currently seeing have corresponded to anywhere near such a rapid increase in unemployment insurance claims. But the 2007-2009 recession, as deep as it was, took time to develop, unlike the very rapidly moving current conditions. Upcoming economic data could well be far out of the range seen in history in multiple ways.