Posted on August 30, 2020

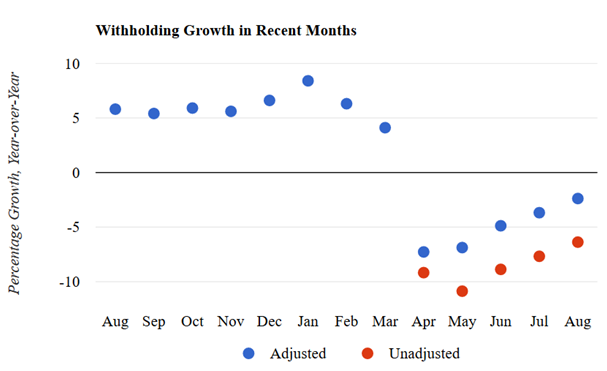

- Federal revenues from withholding of income and payroll taxes continued to improve in August, as the decline on a year-over-year basis (that is, comparing the amounts to those from the same month of a year ago) was an estimated 2.4 percent, compared to a decline of 3.7 percent in July (see first chart below). Those figures remove the estimated effects of law changes enacted in March that reduced withholding but not wages and salaries. Without those law change adjustments, withholding growth also continued to improve–the “unadjusted” data in the first chart below. Although withholding has improved since bottoming in April, there is still a long way to go before it is back to pre-pandemic amounts. Please see our methodology page for more details on how we estimate withholding growth.

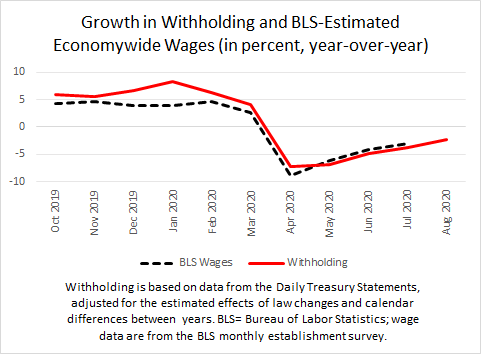

- Withholding tends to move roughly with economywide private sector wages and salaries as estimated by the Bureau of Labor Statistics (BLS) in its monthly establishment survey (see second chart below). The improvement in withholding growth in August suggests continued improvement in data on economywide private sector wage and salary growth for August to be released by BLS on Friday of this week. Movements in economywide wages and salaries stem from some combination of total employment, average hourly earnings, and (generally much more stable) average weekly hours worked.