Posted on November 30, 2020

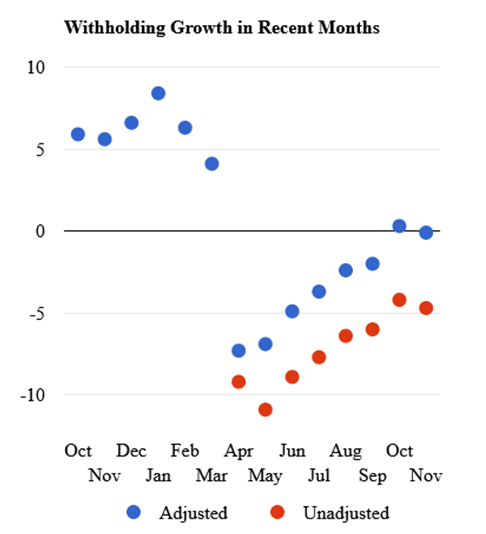

We measure that growth in economywide income and payroll taxes withheld from workers’ paychecks slowed just slightly in November compared to October’s rate of growth. Withholding registered a small 0.3 percent increase in October, relative to the amount in October of 2019, but then fell by 0.1 percent in November on that same year-over-year basis. Those measures remove the estimated effects of tax law changes enacted since March and standardize the number and makeup of business days across months (see the “adjusted” datapoints in the chart below). Although that small dip from slightly positive growth in October to slightly negative growth in November could reflect a weakening labor market as coronavirus infections have surged and some public health restrictions have been reimposed, it seems more likely that our measure of withholding growth was overstated some in October–as we wondered at the time–given the big jump from September’s amount; the slight dip in November could therefore just be a carryover from statistical noise in October. Unless and until we measure a persisting slowdown in withholding growth with future data, it is perhaps best to just focus on the steady improvement since April. The improvement since April also registers in our measure that does not adjust for the effects of recent law changes (the “unadjusted” datapoints in the chart).

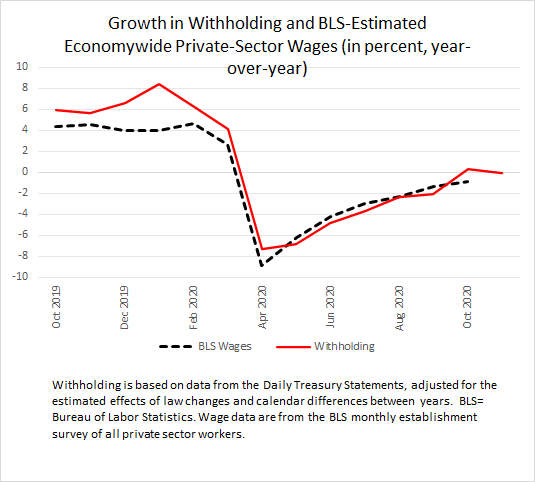

Movements in withholding have tracked movements in overall wage and salaries in the economy (see chart below). The primary determinant of tax withholding is the amount of wages and salaries, although tax law changes, which we attempt to correct for in our measure, are also important. My best guess is that we will observe continued improvement in data on overall wages and salaries for November to be reported on Friday of this week by the U.S. Bureau of Labor Statistics (BLS) in its monthly establishment survey. We are able to obtain very quick, daily measures of withholding growth because employers remit the withholding amounts as soon as the day after they pay their workers, and the Treasury Department reports the total amount received the next day (see methodology).

We were not sure about the signal from our measure of withholding growth in October, which (as mentioned) jumped a good bit compared to that from September. The dispersion of our daily measures was wider than usual in October, and that dispersion was much tighter in November (see chart below). Our technique averages the days in the second half of the month to obtain an estimate of monthly growth–which works to cover activity for the whole month because the daily measures are really a moving average of a few weeks of daily withholding data. Each of the daily measures for the second half of November were right around zero growth relative to the prior year’s amount, but the measures in the second half of October varied much more around zero. A tighter dispersion in November gives us more confidence in the measure.

I have one point on the meaning of about zero percent growth in economywide withholding from year-ago amounts. It might sound fine that withholding in November (adjusted for law changes) is back to amounts from November of a year ago. However, that certainly doesn’t mean that the overall economy has recovered from the recession. There has been population growth and inflation since November of last year, and the economy grew from November to March, so being just back to last year’s amount indicates declines in wages per person and adjusted for inflation. Also, there is normally productivity growth that raises living standards. Without withholding, and by extension wages, being above last year’s amounts, living standards per person have fallen rather than rising as usual in an expanding economy. And much other data shows that the distribution of the lower living standards has disproportionately hit lower-income workers, minorities, and women.

One final point, to be continued later, is that recent measures of economywide wages reported in the National Income and Product Accounts (NIPAs) appear to be diverging some (growing more quickly) relative to what we see from the BLS establishment survey and from the withholding data. We’ll get more data this week on the underlying source of the NIPA data, so we’ll see if we can make any observations then.