Posted on February 14, 2021

Below are some bullet points on recent developments in withholding tax remittances along with two charts:

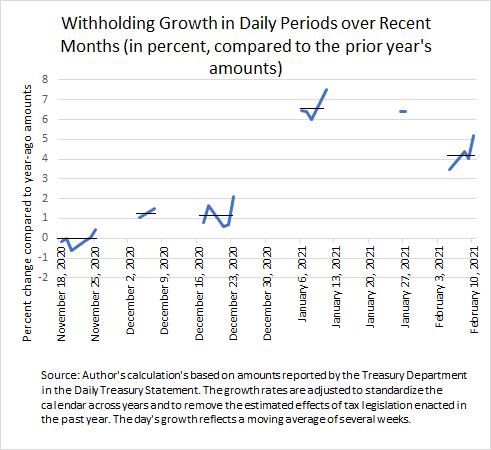

- Daily tax withholding growth in the first half of February (measured relative to year-ago amounts and adjusted to remove the estimated effects of tax law changes) has come down some since the elevated level of January, but remains well above the growth measured in December (see first chart below). Withholding growth tends to move with economywide wages and salaries.

- Because withholding amounts vary significantly over the week and at different points in the month, we look for comparable periods between this year and last year to estimate growth; we have had fewer comparable periods than normal in the past two months, in part because of the January holidays, adding uncertainty to our estimates. If we don’t identify comparable periods, we don’t come up with measurements and the chart shows gaps.

- Unlike for most of 2020, tax law changes have had minimal effects on our withholding estimates for January and February. Last year we had no substantial tax legislation enacted in January and February–before the pandemic hit–and many of the tax law changes enacted subsequently last year expired at the end of 2020. The lack of substantial legislative effects in January and February reduces the uncertainty of our estimates because there is less chance of significant errors in estimating the effects of the legislation.

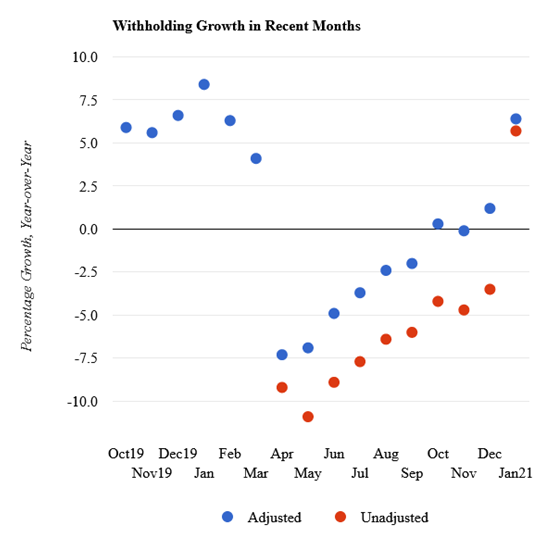

- Withholding growth had improved progressively since April of last year, but the jump up in January was anomalously large (see second chart below and a discussion in a previous post about how movements in January are often volatile and temporary). We’ll see if growth for the rest of February continues to retreat to perhaps show a smaller improvement in withholding since year-end rather than a jump up.