Posted on October 29, 2020

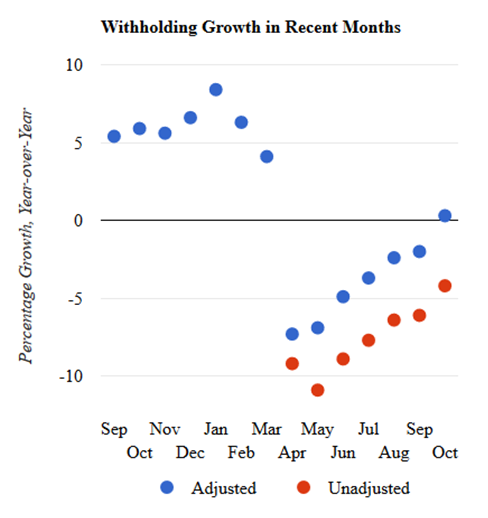

By our measure, income and payroll taxes withheld from workers’ paychecks moved up significantly in October. We estimate that tax withholding was 0.3 percent above the amounts from October of a year ago, measured to remove the estimated effects of federal tax law changes enacted since March and to standardize the number and makeup of business days across months. Withholding growth has now improved in each of the past six months, and the amount of withholding this month exceeded year-ago levels for the first time since March, albeit just slightly (see chart below). The improvement since April has also occurred in withholding unadjusted for law changes. (The law changes, mainly from the CARES Act enacted in March, have reduced withholding.) Nonetheless, withholding on the adjusted basis is just back to October 2019 levels, and the economy continued to grow from October 2019 until March of this year. Withholding still has a substantial way to go to get back to pre-pandemic levels.

The improvement in withholding since April has corresponded well with improvement in wages and salaries in the economy, the prime determinant of withholding other than changes in law (see chart below). We make the adjustment to observed withholding to remove the estimated effects of tax law changes specifically so that we can draw the link from withholding to wages and salaries. (We also include small adjustments for the effects of the President’s executive action in August allowing deferral of the employee side of the Social Security payroll tax through year-end.) We will see if the strong performance of withholding in October corresponds with a particularly strong employment report for the month to be released by the Bureau of Labor Statistics (BLS) at the end of next week.

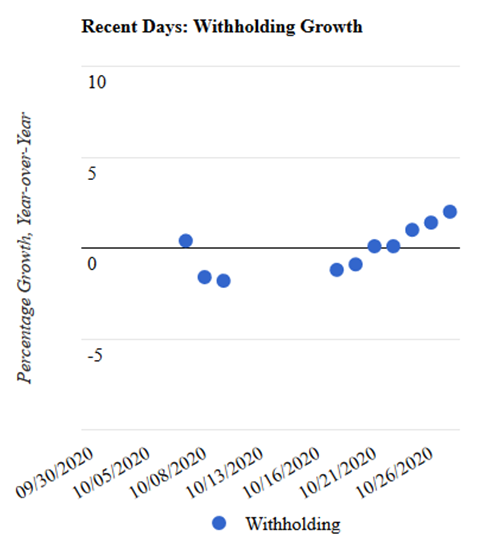

Although I wouldn’t be surprised if there is a strong labor market report next week, I would be a bit surprised if it is very strong as suggested by the withholding data. The main reason for my caution in interpreting the data is that there was more dispersion than usual in our daily measures of withholding growth (see chart below). Recent daily measures were as low as -1.2 percent and as high as +2.0 percent. We average those daily growth rates for the second half of the month to approximate the monthly growth because the daily measures really stem from a moving average covering the prior several weeks. The wider the dispersion of the daily measures, the more uncertainty there should be in the actual measure. And yes, we have a measure of withholding for October even though the month isn’t quite over yet (see methodology). The time period that BLS uses for its monthly labor market report is much more truncated, as its establishment survey (the one that generates estimates of wage growth) uses data from employers for the pay period that contains the 12th day of the month. In any event, we have a little over a week to wait for the BLS employment report for October.