Posted on February 28, 2020

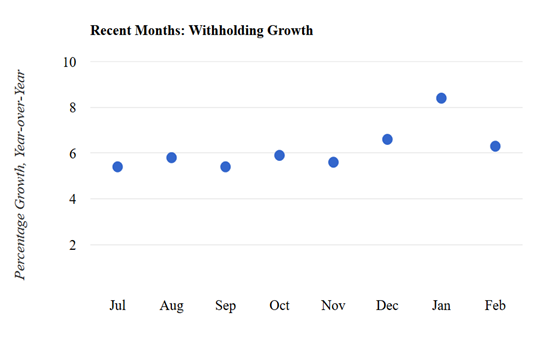

Tax withholding growth in February looks to be just about back to the steady, solid pace of most of the second half of last year. After being slightly elevated in December and especially so in January, withholding growth in February reverted most of the way back to the narrow band of 5.5 percent to 6 percent that it recorded in each month from July through November (see chart). Specifically, I estimate that withholding growth in February was 6.3 percent (measured relative to the amount recorded in February of last year), and in the final days of February was back right around 6 percent. Movements in withholding growth tend to track well with movements in overall wages in the economy (see chart on taxtracking.com).

So, I see no evidence from the daily withholding data of any slowdown in economic growth. It was not a surprise that withholding growth would revert in February, given that withholding in December and January can often move off trend temporarily as a result of year-end bonuses and other irregular income. The holidays can also make it difficult to measure withholding growth appropriately.

Withholding growth, as we measure it, has been remarkably stable since the middle of last year, except notably in January, and that stability is consistent with an economy that has continued to just chug along. Historically, our measure of withholding growth bounces around in a larger band from month to month than we have observed since the middle of last year.

It is certainly unclear how well the U.S. economy can withstand the headwinds from the spread of the coronavirus. Clearly the stock market has been roiled in recent days. As I said, no sign of a slowdown is evident in the the withholding tax data. Neither has the macroeconomic data at present been suggesting a slowdown. According to the latest data, in each of the second through fourth quarters of 2019, the economy grew at a stable 2.0 percent to 2.1 percent rate (on an inflation-adjusted basis, measured quarter-to-quarter at annual rates). Based on various data sources available so far through February, the Federal Reserve Bank of New York, which provides an excellent assessment of current quarter growth on a weekly basis, estimated (as of today) 2.1 percent growth for this quarter. The Federal Reserve Bank of Atlanta, in its widely cited tracking of the economy for current quarter, as of today foresees relatively solid economic growth of 2.6 percent. Those estimates will doubtlessly change as the quarter continues.

The withholding data are among the most real-time measures of the economy. The estimates from the two Federal Reserve banks, while more comprehensive in that they measure overall economic activity, are based on data that are older than the real-time withholding data that we track. The daily withholding tax data are largely based on wages paid by employers two days prior, so they are very current. And wages paid constitute about 43 percent of overall economic activity measured from the income side. Although we don’t measure withholding growth for the week around the end of a month and the beginning of the next one (because of difficult-to-disentangle payday timing issues), we’ll be closely monitoring the withholding data, starting again late next week, for any signs of an economic slowdown.