Posted on February 19, 2020

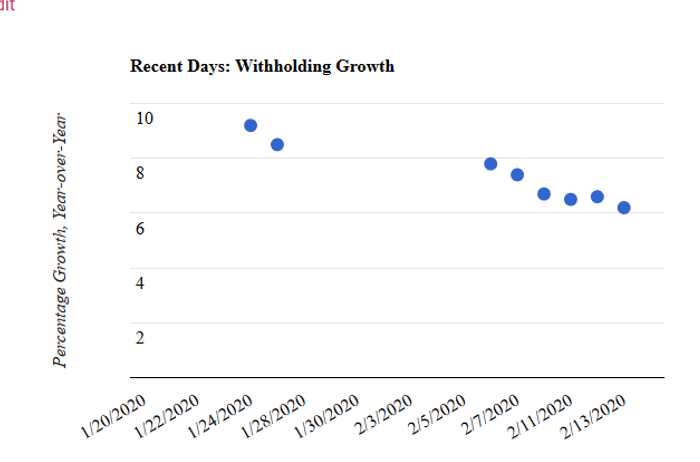

Not surprisingly, federal collections from tax withholding—that is, amounts withheld from paychecks and remitted to the Treasury Department for income and payroll taxes—have been growing more slowly in the first half of February compared to the elevated amounts of growth recorded in December and January. Withholding growth in recent days (see chart above) has been progressively moving down, and by about halfway through February, withholding growth has moved almost back into the relatively stable band of 5.5 percent to 6 percent growth (measured relative to the same periods of a year ago) that were recorded from July through November last year. That reversion in withholding growth so far in February, if confirmed in data for the rest of the month, would be consistent with December and January withholding being boosted by one-time bonuses or other irregular income.

Withholding growth tends to track overall wage growth in the economy (see chart that tracks withholding and wage growth). Indeed, withholding provides an early indication of wage growth because the withholding data are publicly available so quickly (for the biggest firms, two days after the associated wages are paid).

Late next week we’ll have an estimate of withholding growth for the full month of February, based on the Treasury Department’s daily releases of withholding taxes for the final part of February. (Spring is getting nearer!)