Posted on March 31, 2022

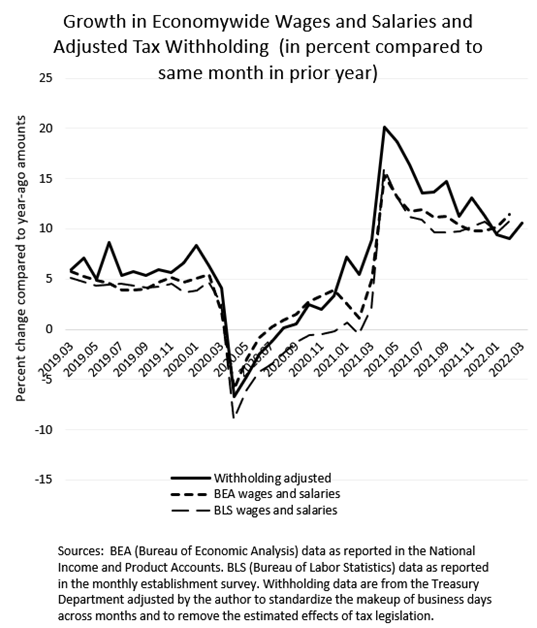

In what is probably a good sign for the economy, tax withholding–the economywide amounts withheld by employers from workers’ paychecks for income and payroll taxes and remitted daily to the U.S Treasury–grew faster in March than in January and February, we estimate. In March, we estimate that withholding was 10.5 percent above the amounts from March of a year ago, a higher year-over-year change than the 9 to 9.5 percent growth recorded in both January and February. Those growth amounts adjust the reported amount of withholding to standardize the makeup of business days across months (because different months often have a different number of business days and the days on which more or fewer remittances are made) and also adjust to remove the estimated effects of tax law changes that affect withholding but not wages and salaries (currently a relatively small adjustment). Tax withholding as we measure it is thus a proxy for wages and salaries in the overall economy, and withholding is available more quickly than direct measures of economywide wages and salaries.

We have now observed year-over-year growth in withholding in the vicinity of 10 percent for three consecutive months, which is substantially higher than the pre-pandemic growth that was more in the 5 percent to 6 percent range.

Higher inflation is clearly involved in the faster withholding growth, as the amounts are all measured in current dollars. Workers’ average hourly earnings have clearly picked up, as shown from other data sources. The increase in withholding growth is a good sign for the economy as long as it is not all from inflationary gains, or from statistical noise (see below).

Withholding growth can also be compared to direct measures of wages and salaries. Throughout most of the recent economic recovery until recently, withholding growth exceeded growth in wages and salaries as measured by both the Bureau of Labor Statistics (BLS) in its monthly establishment survey (with the report for March to be released tomorrow) and by the Bureau of Economic Analysis (BEA) as a part of its monthly report on GDP. In the past few months, however, growth in wages and salaries as measured by those two federal agencies has been slightly exceeding withholding growth (again, see the chart). We do not yet have the BLS and BEA measures of wages for March, however.

Faster growth in economywide wages than in withholding suggests that lower-income individuals are obtaining larger pay gains than middle- and especially higher-income individuals. Because lower-income taxpayers face lower tax rates on labor income compared to higher-income taxpayers, disproportionately higher growth in wages by lower-income individuals would lower average tax rates in the economy and push down withholding growth relative to wage growth–the opposite phenomenon that has dominated most of the past 40 or so years. It is also possible that the economywide wage measures will be revised down in the future to line up more with the withholding data, as has occurred frequently in the past.

We will see if the increase in withholding growth in March portends a strong jobs report for the month to be released by BLS tomorrow. But the increase in withholding growth could be from increases in average hourly earnings, rather than from an increase in employment. The pickup in withholding is most likely from some combination of increases in employment and hourly earnings. The withholding data also contain some statistical noise (as do the BLS and BEA measures of wages, which can often be revised substantially), so that any one month’s worth of data may not be fully reflective of the true movements in the economy.