Posted on January 31, 2023

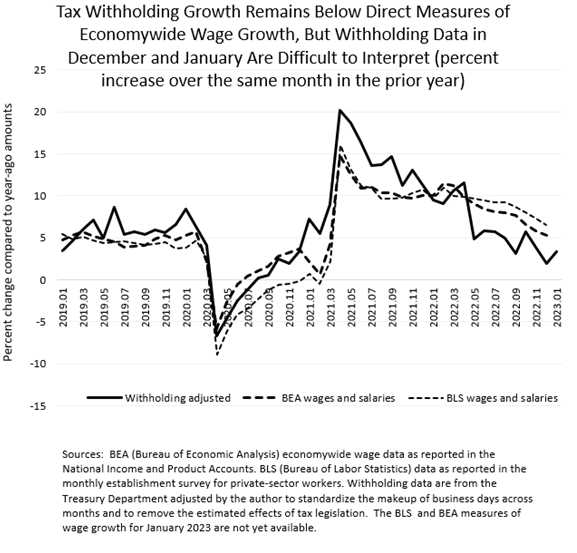

Growth in federal withheld tax payments remained low in January, according to our estimates that adjust the reported amount of withholding for tax law changes and differences in the calendar across months. We estimate that tax withholding grew by 3.4 percent in January (compared to the amounts from January of a year ago). That growth is higher than the 1.9 percent measured in December, and together they are below the amounts recorded in the autumn of 2022 (see chart below). The measurements of withholding growth for December and January are always much more uncertain than for other months because of the effects of year-end bonuses and the multiple holidays, as well this year from the effects of law changes that affected December withholding (see post about withholding in December).

The growth in direct measures of economywide wages and salaries has been above withholding growth since the spring of 2022, although the gap has narrowed some in recent months (again see the chart below). Wage growth as measured in recent months through December by both the Bureau of Economic Analysis (BEA, in its monthly GDP release) and by the Bureau of Labor Statistics (BLS, in its monthly establishment survey of private-sector workers) has exceeded the measure of withholding growth. Those wage measures are not yet available for January.

The gap between wage growth and withholding growth could reflect various factors, two in particular. First, the wage measure from BEA, which is more comprehensive than the survey-based measure from BLS, may be revised in future months as administrative data become available from the Quarterly Census of Employment and Wages (QCEW). Those QCEW data come from nearly all employers in the economy, who report their overall payroll information to the states for purposes of administering the unemployment insurance program. Second, average tax rates may have fallen, which would stem from overall tax withholding falling relative to wages; that would be consistent with recent wage growth being relatively higher for lower-wage workers, who face lower tax rates. Some data, such as that compiled by economists Blanchet, Saez, and Zucman, suggest that the wages of lower-wage workers overall have been growing relatively faster after being hit especially hard during the worst of the pandemic in 2020.

The withholding data in December and January don’t shed much light on the sources of the gap between withholding and wage growth, in part because withholding amounts in the past two months have been highly affected by year-end bonuses. Those bonuses go disproportionately to higher-wage workers, thus potentially causing changes to average tax rates that can temporarily break the link between overall withholding growth and wage growth. In addition, the multiple holidays in December and January make it harder to get reliable measurements of withholding growth for those months. Withholding growth in future months should give a better indication of the strength of economywide wages and salaries.